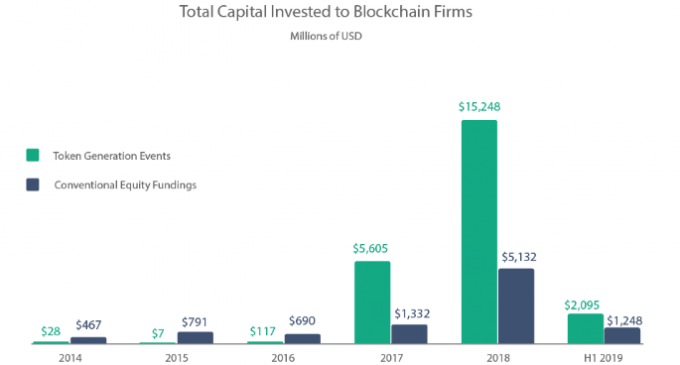

Although ICO funding peaked out in 2018, when the total amount raised by blockchain-based startups was $15.24 billion, the first half of 2019 had been encouraging, as teQatlas analytics firm showed in a recent report, published on August 1st.

Just recently we’ve seen how Germany’s BaFin approved a $250 million ICO, showing that the largest European economy wants to rely heavily on blockchain applications. The past two years were a rollercoaster for the ICO industry, given the regulatory turmoil that emerged at the beginning of 2018, which continues to leave its mark on the industry even at the time of writing.

ICOs overcome VC investments

According to the teQatlas report, “Token Generation Events (TGE)”, an alternative term to ICO, managed to raise $2.09 billion in the first half of 2019, almost twice as much as venture capital (VC) investments into blockchain firms.

The report is based on an analysis conducted on approx. 2,500 blockchain companies, backed by 1,800 investors and found that blockchain-based startups continue to represent a high-margin investment.

As we see movement in the regulation sectors, with countries like France adopting new laws for ICOs, there could be hopes for improvement in the near future, although the record set in 2018 seems hard to reach at this point. Still, the total number of ICOs and VC investments reached 268 transactions during the first half of this year, which means that we may get at least 50% of what we saw in 2018 when there were 910 transactions reported.

Regulatory uncertainty weight on sentiment

Despite an encouraging sign of blockchain-based startups that try to fund their activities through ICOs or IEOs, the funding had been on a downtrend, both on a monthly and quarterly basis, since the beginning of 2018, a sign of investors’ caution in the context of regulatory unclarity. We still don’t have a clear and globalized regulatory framework, needed for these companies to operate internationally without any impediments.

At the present time, some companies are taking significant risks, given that any unexpected law could dampen their activity and disrupt business models. The teQatlas findings come in contrast with other companies that made similar researches and found that the ICO industry is in a much better position.

It’s something usual to see artificially inflated number into the crypto sphere, but the bottom line is that conditions are still depressed as compared to the end of 2017 when enthusiasm was at its peak and investors were jumping into any kind of project, just out of fear of mission out the hype.

There are no comments at the moment, do you want to add one?

Write a comment