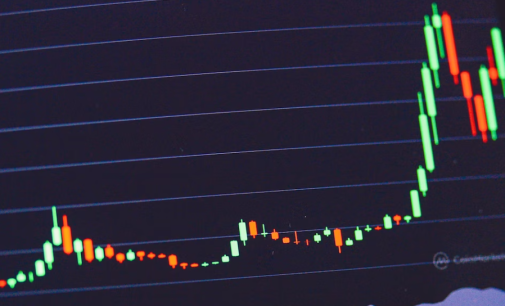

BTCUSD (Coinbase) Bitcoin’s volatility has been compressing over the last week and now we see the price locked between the daily 20 EMA and $18,600. There is a lack of momentum in the market right now, suggesting participants are waiting on the sidelines for the next impulsive move to start.

Weekly Crypto Analysis by Crypto Frontline

BTCUSD (Coinbase) Bitcoin continued to sell off once we published our last weekly analysis but managed to find a bottom around $18,200. The FED press conference was very hawkish and surprised on the upside in terms of interest rate expectations. Obviously, the US Dollar moved up and crushed all risk

BTCUSD (Coinbase) Despite an encouraging start of the week, Bitcoin is poised to end in red, mainly due to the losses that started to unwind once the US inflation figures were released. Investors and traders fear inflation is sticky and that could prompt more hawkishness from central banks, in particular

BTCUSD (Coinbase) Bitcoin reached the $19,000 area as we’ve expected last week but once that happened, an impulsive rally started to unfold. By the time of writing, buyers managed to push the price towards $21,700, a key resistance and a potential neckline for an inverted head-and-shoulders pattern. If that’s the

BTCUSD (Coinbase) Conditions have not changed with Bitcoin and even if the price has been consolidating over the past week, the sellers are still the ones in control. Right now we see BTC attempting to break below a short-term triangle formation and the probability favors a continuation lower. Low appetite

BTCUSD (Coinbase) The FED’s chair speech at the Jackson Hole Symposium was a real drag on risk assets and even Bitcoin suffered as a result of the hawkish stance. Central banks aren’t willing to show any sign of pivot, so in the meantime, there is nothing to support current valuations.

BTCUSD (Coinbase) The pain seems to have not ended for Bitcoin, considering last week was a bearish one. The price broke below our channel impulsively and now our view shifted in favor of sellers for the near term. This week will bring the Jackson Hole Symposium, where the markets expect

BTCUSD (Coinbase) Summer trading time is now the norm and we continue to see subdued ranges in the price of Bitcoin. Even though it reached $25k, buyers were unable to sustain the gains, something that usually happens in a market where liquidity is thin and false breakouts occur often. The

BTCUSD (Coinbase) Another week passed and still, Bitcoin continues to post a sluggish performance, suggesting a lack of appetite for riskier assets. The price was mostly on the retreat, even if it did not breach the channel we talked about last week. Because the ranges are narrow, we’ll focus on

BTCUSD (Coinbase) It has been another steady week for Bitcoin and given the price managed to break above the July 20th high, that further reinforces the slight bullish strength. We can easily notice that BTC is moving up in an ascending channel formation, so as long as it remains in