Trading bitcoin is not different than trading other financial contracts like forex or commodities. Also, now that more and more brokers have included bitcoin on their instruments list, you can also profit from bitcoin price movements while applying the same methods you already know. This article will discuss a simple and basic setup any of you could use to generate profit while trading bitcoin.

Breakout-pullback system

This is a trading setup that helps you exploit trending environment, so it will offer you with-trend trading signals. By using it you will be able to profit from the dominant movement of the price and avoid being trapped in the wrong direction of the market.

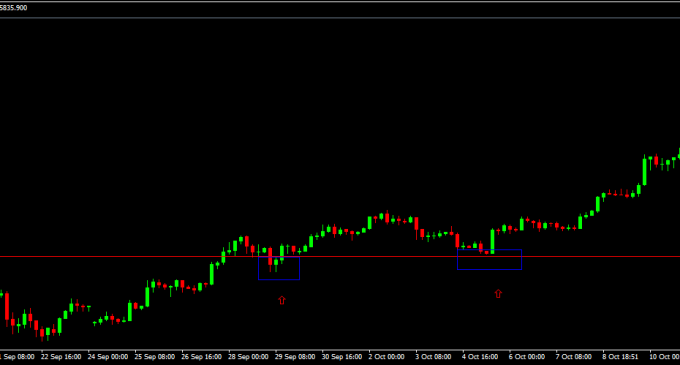

Let’s dig into to actual rules of the setup by looking at our picture below. As you can see, we have drawn a line around the 4124 level which was a resistance level before the market managed to break it. Following the breakout, you can observe that the price managed to retreat to the resistance level.

But then, the buying pressure resumed and the price managed to break higher. The market offered also a second opportunity to get long by retreating again towards our level and then the price surged towards the 6000$ mark, that had been reached last week.

Best way to trade this setup is to put your entry around the area that you are looking at, without waiting for some sort of confirmation signals. By doing that, you will be able to minimize your risk and increase your profit potential.

With that being said, this is a setup any trader could integrate into their trading regime since it is very simple to understand and highly effective in terms of profit potential.

Risk Warning and Disclaimer

Trading cryptocurrencies on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in cryptocurrencies you should carefully consider your investment objectives, level of experience, and risk appetite. No information or opinion contained on this site should be taken as a solicitation or offer to buy or sell any currency, equity or other financial instruments or services. Past performance is no indication or guarantee of future performance.

There are no comments at the moment, do you want to add one?

Write a comment