Bitcoin

Source: tradingview.com

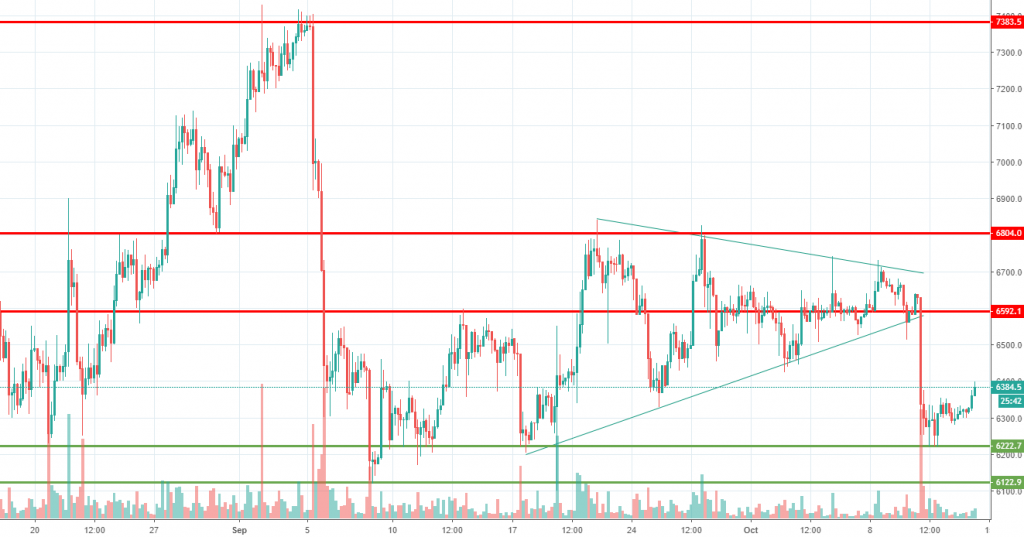

During this past week, Bitcoin had moved lower following comments from the International Monetary Fund regarding digital assets. We’ve mentioned at the beginning of the week that Bitcoin volatility is compressed and a break should happen shortly. The breakout happened on the downside, but we are still inside the major downside triangle which we discussed in the last weekly crypto analysis.

The price action had found support around 6,200 and managed to consolidate higher for three days in a row following the slump. Even if the downside will resume, we expect the level to hold, together with 6,100 forming a nice demand area.

On the upside, resistance should be encountered around 6,600 if the move will continue to extend higher. Remember that above it we have the 6,800 key area, so what will happen there, if the price reaches it, will be key in determining the future dominant direction.

Ethereum

Source: tradingview.com

The Ethereum price had been dragged lower by the Bitcoin selloff, as it had been the case with some other major cryptocurrencies. The price action had managed to find support around 190, a level which we had mentioned last week, but still, what we see following that is a very weak recovery, suggesting that bulls are not so eager to buy on the dip.

If we don’t see the price picking up soon, we might witness a new breakout below the 190 which might expose the current 2018 low, located around the 170 area.

However, we do not expect any major breakout on the downside. We do think that the price might consolidate in the medium term between 250 and 170-180. Any significant news could contribute to a breakout on either side, so you should be up-to-date with all the latest highlights.

Tron

Source: tradingview.com

A few weeks ago we have talked about Tron and at that time we thought a double bottom formation was likely to form. We were not right, unfortunately, but we still managed to spot some key levels and also it seems like a bottoming formation is under development.

The 0.027 key resistance area had been reached and sellers managed to push the price lower but what we are seeing right now is bulls stepping in and driving the price lower. If they will manage to push the price towards the key resistance that will qualify the structure as a pre-breakout formation and the prospects of Tron moving higher will be substantial. Above the resistance, we suspect 0.038 will be a target achievable until the end of 2018.

It is also possible that we could see the price hovering around the 0.027 key resistance for a while, but as long as buyers step in on the dips, our view will remain unchanged.

Briefings about ICOs

According to tokenmarket.net, Aceso is an ICO project that will start on October 15, tomorrow. It represents a user to user cyber threat intelligence, with the main aim of the project being to reduce the expenses with protecting a computer to a minimum of $1.

In terms of ICOs that are still active, EverMarkets Exchange is an ICO that will end on October 18th. It wants to reimage the trading landscape and give the ability to trade global futures contracts on a single platform.

There are no comments at the moment, do you want to add one?

Write a comment