BTCUSD (Coinbase)

Bitcoin buyers have not been strong enough last week, hence the price failed to break and hold above the $30,000 key area. As we expected, a cluster of resistance was found around that level, since the 200 SMA + a falling trend line were overlapping there.

In the meantime, a triangle pattern seems to forming and the volatility compression suggests an impulsive move will follow once the market breaks on either side. Above $29,700 we favor a retest of $30,000 and if that will be the case, we give credit to a break and continuation higher towards $31,300.

On the flip side, if Bitcoin weakens below $28,800 and does not find bids, then the next support to watch would be $28,500. Breaking below the triangle could signal further losses toward $27,400. At this stage, conditions are slightly in favor of buyers, with the only thing left to do being the break above $30k. Traders looking for longer-term plays should remain in wait-and-see mode until the choppiness ends.

ETHUSD (Kraken)

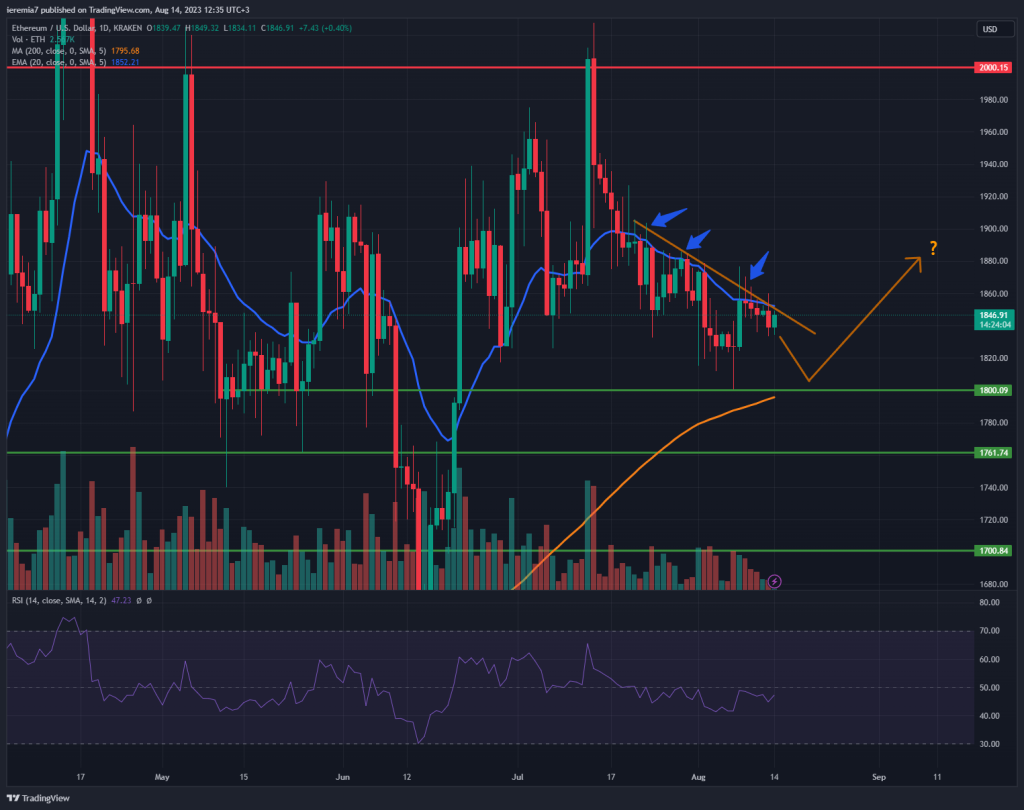

ETH buying is also not convincing enough and technicals are pointing to indecision among market participants. Despite a short-term push higher at the beginning of last week, follow-through failed to materialize.

The market continues to treat the daily 20 EMA as a resistance zone since the price rejected around it multiple times during the last month. At this stage, the safest place for a buying order is near $1,800, where the daily 200 SMA is also located. We expect stronger bids if the price weakens towards the area. A continuation below could suggest ETH is poised for a retest of $1,700, but this is the less-likely scenario right now.

Breaking and holding confidently above the 20 EMA is the hint we want to see for a stronger bullish appetite. If that happens, then ETH has a clear path ahead toward $1,900 and even $2,000, which is a stronger resistance zone.

UNIUSD (Coinbase)

While BTC and ETH are choppy, traders need to shift their focus to the altcoins space. Uniswap is a better choice, considering its price has been in an uptrend since mid-June. As you can see from the price, the buying was strong enough to break and hold above the daily 200 SMA. At the same time, the price managed to trade above the 20 EMA for most of this period, suggesting a strong bullish momentum.

Given such circumstances, we favor more upside gains and the first resistance level to watch is $6.5 A break above the current August highs will unlock further upside potential, and $7.35 – $7.7 will become the next likely resistance area. The bullish appetite will be supported if there is broad-based crypto buying.

Traders should not ignore the bearish scenario, especially since UNI is trading not far from the 200 SMA. A break and hold below the orange line will be the first sign of weakness. That could mean a retest of $5 will be on the cards.

There are no comments at the moment, do you want to add one?

Write a comment