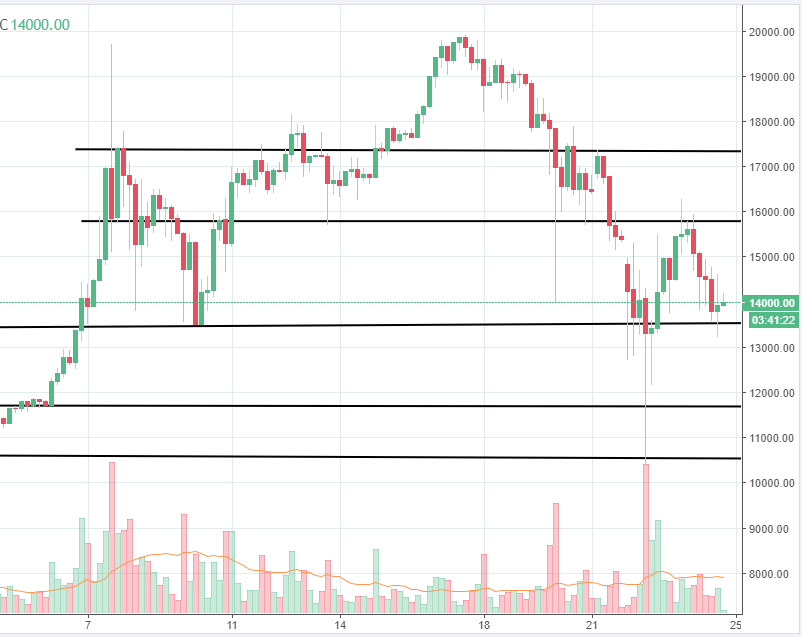

Bitcoin

This week had been by far the worse trading week for bitcoin. The price was down almost 40% at one point and from our point of view, this selloff will definitely hurt confidence over the near future. Latest headlines point out that bitcoin.com co-founder Emil Oldenburg had reportedly sold off all his bitcoin holdings and cashed in on Bitcoin Cash. According to an interview from the site Breakit, it seems like he is concerned about the block size limit of bitcoin. Currently, the bitcoin block-size limit is 1 megabyte. Bitcoin Cash, however, has an advantage from this point of view, with a block-size limit of 8 megabytes. As Oldenburg said, this could lead to much lower fees and more liquid investment.

Source: dailyfx.com

Now talking about the technical structure of the price, you can notice that buyers emerged around the 13,520 area, where a support level could be seen. At the time of writing, we can see the price is bouncing again off that area, confirming that there is buying interest. On the upside, we expect the price to find resistance around 15,830 level, where the current selloff started today. Only a breakout above that level could signal a potential continuation towards 17,350.

On the downside, if the 13,520 support will fail, further selling pressure could drive the price towards 11,700 or even 10,560, where buyers could emerge again.

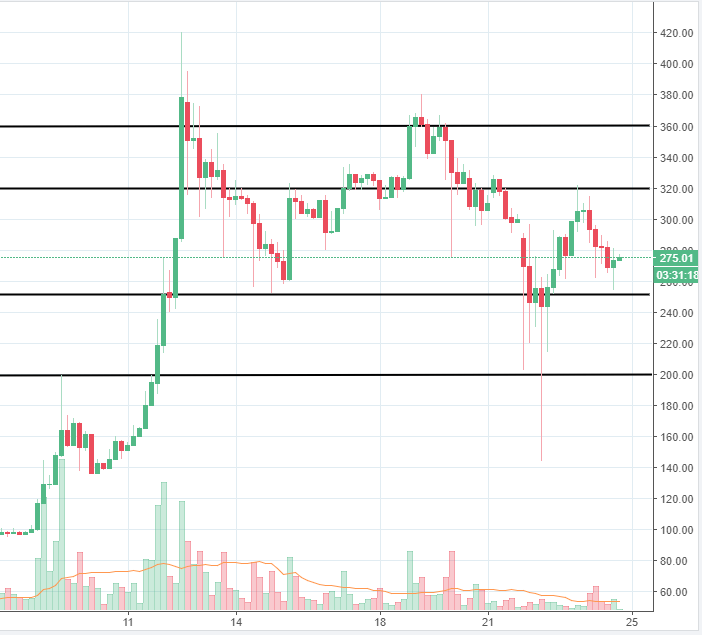

Litecoin

Coincidence or not, the Litecoin creator, Charlie Lee, had reportedly sold his entire litecoin stake. As the news is stating, the LTC creator had sold his entire stake and donated it to Litecoin Foundation. The selling frenzy begun after the news had been released on Wednesday and the Litecoin price had dropped by more than 60% on the Coinbase exchange. The all-time high is located at 420 US dollars per piece and on December 22nd the price reached a low of 144 US dollars per piece. The price rebounded and is currently trading at 275, but this kind of moves, similar to bitcoin, cannot be followed by strong buying. A stock like this one can definitely destroy bullish momentum and we believe buyers are now questioning the health of the bullish trend they have seen this year.

Source: dailyfx.com

We expect buyers to emerge around the 250 price level if the price reaches it. If sellers manage to drive the price below it, we expect support to follow around the 200 psychological area. On the upside, if bulls continue to push the price on the upside, around the 320 level some selling interest could emerge again.

Since the last week of the year is due to follow, we expect price variations to be small and volatility to be reduced, as compared to this week. We don’t expect the market to move at the same pace we’ve seen in the last few days.

There are no comments at the moment, do you want to add one?

Write a comment