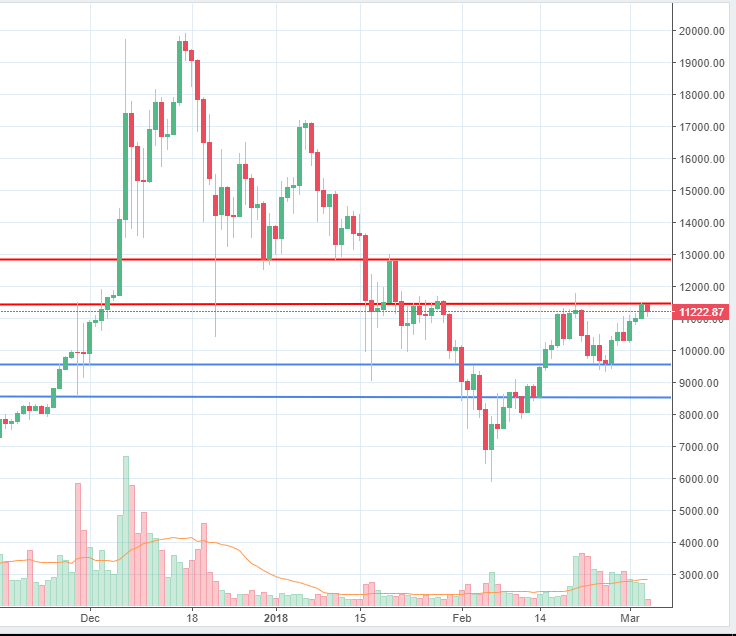

Bitcoin

For the past week, the Bitcoin price had a decent performance, bottoming around the 9,500 area and rising towards our key resistance level located around 11,500. Even though the price action dropped by 2% in the middle of the week, following an SEC probe, all the losses had been erased and now the buyers are pressuring again the key resistance. So far, the interest in selling does not show too impulsive, but we can already see some signs of weakness.

In the bulls will manage to break on the upside, the next target is located around the 12,800 area. Sellers could be there to short the cryptocurrency. On the downside, support is expected around 9,500 area, while a breach of that zone will open more room for sellers towards the 8,500 figure.

Even though the Bitcoin price had managed to rebound since it reached the 6,000 area by almost 100%, risks to the downside persist.

Source: dailyfx.com

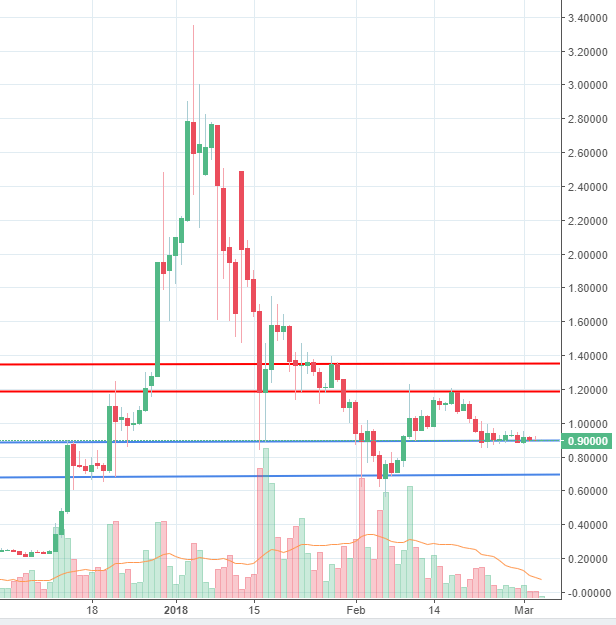

Ripple

The price of Ripple had traded in an extremely narrow range for the last seven days, the smallest weekly range since the beginning of December. Even though there had been fresh news that stated South Korean bank to end Ripple trial, the price action still had not responded. It is currently laying around the 0.90 support level and that is one of the levels where we expect buying to begin.

If not, a continuation lower, towards the 0.67 support could be seen. Overall, we expect the price to have a limited downside, as the interest for the cryptocurrency is on the way up. The San Francisco-based company enjoys attention from a huge number of big institutions and that should be a good catalyzer for buying.

On the way up, resistance should be expected around the 1.20 level, where the current leg down had started. Above it, 1.38 is another level which should be watched by the sellers.

Source: dailyfx.com

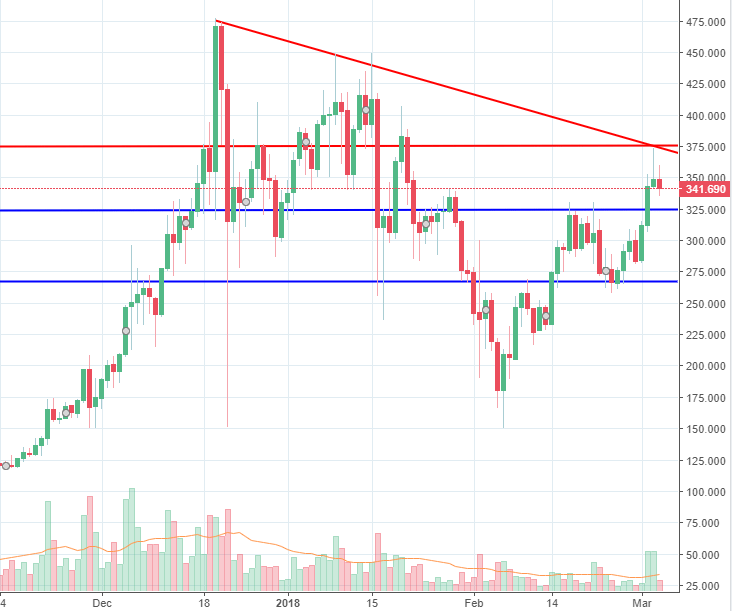

Monero

Monero is a cryptocurrency that had been trading on the upside for the past week. The price is up by more than 25% and it is currently showing signs of weakness after reaching a strong resistance area. You can see the descending trend line + the 375 resistance level converging on a spot. We should see strong selling interest there if the buyers will push the price on the upside. A breakout above will mean the last year high will be under pressure.

On the other hand, if the sellers will manage to keep the price below the trend line, a new wave of selling will begin. Support is expected around 325 level and 270, where the current bullish leg had started.

We do not expect a break above the trend line in the following week.

Source: dailyfx.com

There are no comments at the moment, do you want to add one?

Write a comment