Introduction

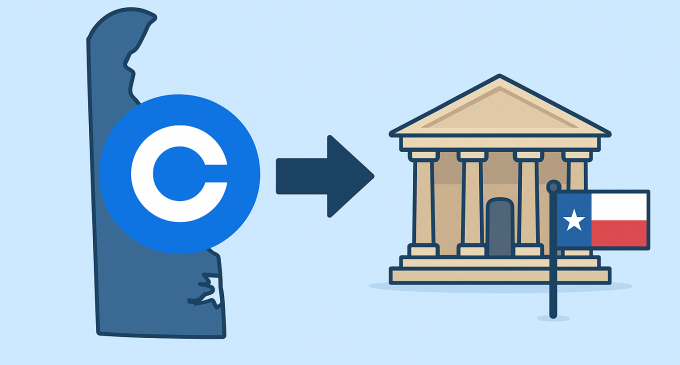

In a major corporate development, Coinbase Global Inc., one of the world’s largest cryptocurrency exchanges, has announced that it will reincorporate in the state of Texas, leaving behind its long-standing legal base in Delaware. The move represents more than a change of address — it marks a pivotal moment in the evolution of both the crypto industry and the broader corporate landscape in the United States.

Texas, long known for its business-friendly climate, is quickly emerging as a hub for technology and blockchain innovation. Coinbase’s leadership cited several reasons for the decision: lower taxes, reduced regulatory friction, clearer business legislation, and a more favorable environment for crypto innovation. This decision positions Coinbase at the forefront of what many are calling a “Dexit” — a growing trend of major corporations leaving Delaware in search of jurisdictions that better align with their modern needs.

The Legacy Of Delaware And Why Coinbase Is Moving On?

For over a century, Delaware has been the go-to state for corporations seeking legal incorporation in the U.S. Its well-established court system, predictable case law, and streamlined corporate governance framework made it the preferred choice for over half of America’s publicly traded companies. However, in recent years, there has been growing dissatisfaction among large corporations regarding evolving court interpretations, rising litigation risk, and the perception of increasing hostility toward corporate boards.

Coinbase, like many firms before it, once chose Delaware for its strong corporate legal foundation. However, as Chief Legal Officer Paul Grewal stated, Delaware’s legal environment has shifted, with courts taking a more aggressive stance in cases involving executive compensation, shareholder disputes, and board oversight. These developments have led Coinbase to seek a jurisdiction that aligns better with its fast-paced, innovation-driven business model.

The decision to move away from Delaware does not come lightly. It symbolizes a recalibration of corporate priorities, where agility, innovation, and regulatory clarity now outweigh legacy legal prestige.

Why Texas?

A Business-Friendly Climate

Texas has rapidly become a top destination for companies across industries — from energy and technology to manufacturing and now, digital finance. The state’s lack of personal income tax, competitive corporate tax structure, and supportive political environment make it particularly attractive to firms seeking operational efficiency and lower overhead costs.

For Coinbase, these factors represent not only cost savings but also strategic alignment. The company operates in a highly dynamic regulatory space, and Texas offers a state government that welcomes innovation while striving to create legal frameworks tailored to emerging industries.

A Growing Blockchain and Crypto Hub

Texas has made significant strides in positioning itself as a national center for blockchain and cryptocurrency development. The state legislature has introduced several pro-blockchain bills designed to encourage responsible innovation, protect digital asset ownership, and create a fertile ground for crypto businesses.

For Coinbase, whose core mission revolves around increasing global access to the crypto economy, Texas provides a supportive ecosystem that values technological advancement. This environment is conducive to long-term growth, product experimentation, and policy collaboration — all critical components for success in the fast-evolving crypto market.

Symbolic and Strategic Significance

Beyond practical considerations, Coinbase’s decision to move to Texas sends a strong message about the company’s future direction. It positions Coinbase as an innovator willing to challenge convention, seek regulatory clarity, and lead by example. The move also reinforces the idea that the next wave of corporate innovation may not be confined to traditional financial centers like New York or Delaware but could instead emerge from new technology-forward states like Texas.

Implications For Coinbase And The Broader Industry

Legal and Governance Changes

By changing its legal domicile, Coinbase effectively shifts the jurisdiction governing its corporate law, shareholder rights, and litigation exposure. Delaware has long been known for shareholder-friendly rulings, but that predictability has also come with increased litigation and court involvement in corporate decision-making.

In Texas, Coinbase expects a more balanced approach — one that respects corporate governance autonomy while providing efficient legal recourse when needed. This could allow the company to make faster strategic decisions, allocate resources more flexibly, and protect itself from the escalating legal costs associated with Delaware’s judicial system.

Investor and Market Reactions

Investors are watching closely to see how this move affects Coinbase’s governance and long-term growth. While some may worry that Texas lacks Delaware’s century-old legal framework, others see this as a bold step that could reduce unnecessary legal exposure and signal confidence in the company’s growth trajectory.

Coinbase’s transition is also expected to enhance its appeal among innovation-driven investors who prioritize operational efficiency and strategic clarity over legal tradition. By establishing a base in Texas, Coinbase underscores its belief that the U.S. crypto industry can thrive under transparent, business-friendly regulations.

Strengthening Regulatory Relationships

The relocation also presents Coinbase with new opportunities to collaborate with Texas regulators and policymakers who are eager to make the state a leader in blockchain adoption. Texas’s openness to dialogue and its efforts to attract crypto businesses could provide Coinbase a valuable platform to influence the development of clear, balanced digital asset policies — something the company has long advocated at the national level.

Impact on Employees and Operations

While Coinbase’s physical operations are spread globally, the legal reincorporation may lead to internal restructuring in tax management, compliance processes, and governance systems. For employees, particularly those based in the U.S., the shift reinforces the company’s long-term vision of operating in environments that value innovation, financial freedom, and entrepreneurship.

The Broader Context: The Delaware Exodus

Coinbase’s decision is not an isolated event. Over the past few years, several high-profile corporations — particularly in the technology and innovation sectors — have opted to leave Delaware, citing similar concerns about litigation risk and evolving court standards.

This movement, sometimes called “Dexit,” marks a significant change in the U.S. corporate landscape. While Delaware still holds the majority of corporate incorporations, its grip is weakening as other states compete more aggressively by modernizing laws and offering attractive alternatives.

Texas has positioned itself at the forefront of this shift, combining traditional business advantages with forward-thinking policies. By offering specialized business courts, new corporate legislation, and an increasingly robust tech ecosystem, Texas has become a magnet for both startups and large firms seeking flexibility and lower regulatory burdens.

Coinbase’s decision to reincorporate there could serve as a catalyst, encouraging other fintech and crypto-related companies to follow suit.

Implications For The Crypto Sector

A Vote of Confidence in State-Level Innovation

Coinbase’s move signals a clear vote of confidence in state-level efforts to modernize digital asset regulation. By aligning with Texas, the company demonstrates faith in local jurisdictions to build thoughtful frameworks that encourage innovation without stifling growth.

Potential Ripple Effects

Other crypto exchanges, blockchain startups, and fintech companies may be inspired to reconsider where they are legally based. States like Florida, Wyoming, and Texas have already enacted favorable crypto legislation, and Coinbase’s move could validate their approach, accelerating competition among states to attract crypto businesses.

Positioning for Future Growth

In the longer term, Coinbase’s relocation may also improve its positioning in global markets. A more flexible legal home base, combined with supportive state policy, can help the company roll out new financial products faster, form partnerships with emerging blockchain ecosystems, and advocate more effectively for balanced crypto regulation at the federal level.

Challenges Ahead

Despite the clear advantages, Coinbase’s transition will not be without challenges. Changing a company’s legal domicile involves navigating complex regulatory, tax, and administrative requirements. The company will also need to reassure shareholders that governance standards remain strong and transparent.

Additionally, while Texas’s regulatory landscape is more favorable, the company still faces the broader uncertainty of U.S. federal crypto regulation, which remains fragmented and sometimes adversarial. Coinbase’s leadership will need to balance optimism about the new jurisdiction with realistic expectations about ongoing federal oversight.

There is also the question of perception: some critics may view the move as a strategy to avoid stricter corporate accountability measures, while others will see it as a proactive step toward operational independence. How Coinbase manages this narrative will shape its reputation in the years ahead.

The Bigger Picture: A Glimpse Into The Future Of Corporate America

Coinbase’s reincorporation marks a turning point in how companies — especially those in emerging industries — think about their legal and operational foundations. The move reflects a growing recognition that agility, innovation, and alignment with forward-looking jurisdictions can be as valuable as legacy legal frameworks.

For the crypto industry, it reinforces the idea that decentralization isn’t just a technological principle — it can also extend to how companies structure and govern themselves. As states compete to attract the next wave of digital innovators, the United States may see a more diversified corporate landscape emerge, one where states like Texas become synonymous with technological progress.

Conclusion

Coinbase’s decision to move its legal home from Delaware to Texas marks a defining moment in both its corporate journey and the evolution of the U.S. crypto sector. It reflects a strategic realignment toward flexibility, innovation, and business-friendly governance — qualities increasingly vital in a rapidly transforming global economy.

By aligning with Texas, Coinbase is betting on a future where states play a larger role in shaping the rules of digital finance. The move represents confidence in a jurisdiction that values entrepreneurship, supports blockchain innovation, and offers legal predictability without excessive interference.

There are no comments at the moment, do you want to add one?

Write a comment