BTCUSD (Bitstamp)

In line with our last week’s expectations, Bitcoin did reach the $25,000 support area and bounced impulsively off of it. We continue to believe that zone can cap the downside unless an unexpected risk event pops up in the media.

Volatility seems to be compressing and BTC is now trapped between the falling trend line on the chart and the above-mentioned support. A break of $27,000 will be a sign favorable for buyers and could mean there’s scope for further upside towards $30,000, the next key resistance area traders should watch.

Conversely, if the $25,000 fails to cap strong selling, we believe a retest of the daily 200 SMA will be the next move. Below that important moving average things will turn out to be bad for bulls since we can see the next support near $21,500. Also, when the market is trading below the 200 SMA that’s a sign of bearish sentiment. As things stand right now, we expect subdued volatility in the week ahead.

ETHUSD (Kraken)

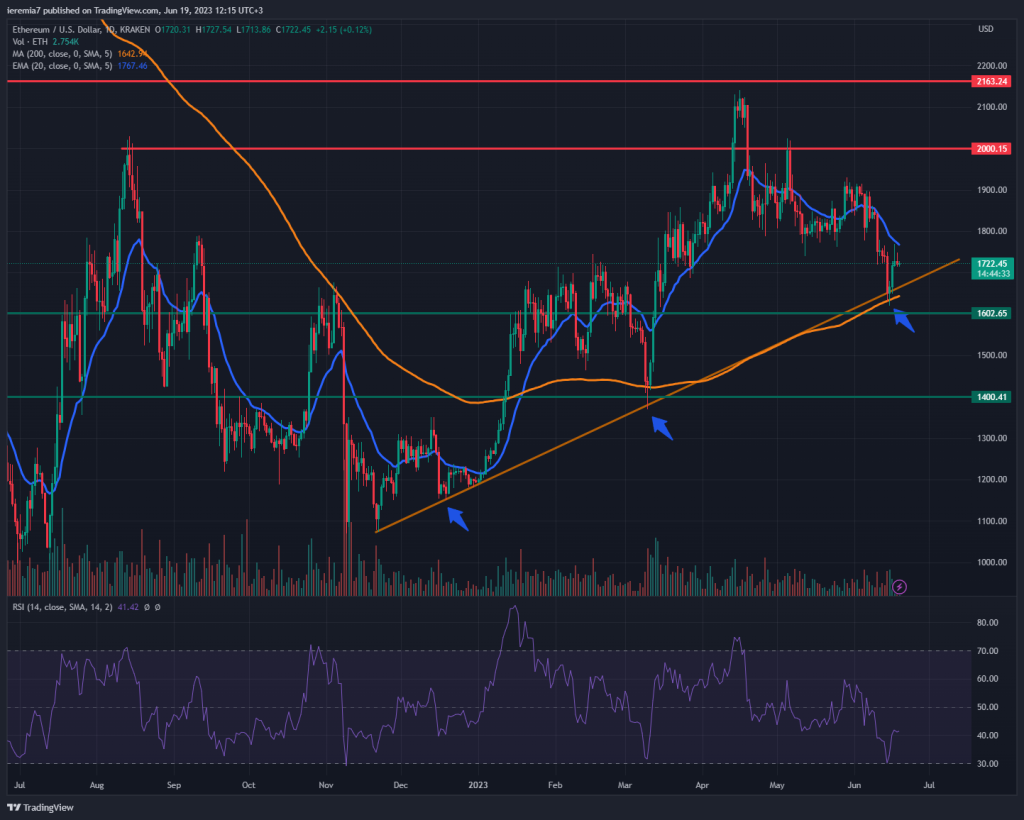

Ether also continued to weaken, but the daily 200 SMA as well as an ascending trend line managed to turn the tide. Sellers were unable to push the market lower, suggesting the bearish sentiment has also been short-lived.

However, that doesn’t mean we are heading toward new highs for the year, given ETH must first breach several key resistance zones. The first one is the daily 20 EMA, that has been treated as a supply zone for weeks. Only after the price closes well above it, should we expect a continuation towards $1,900 – $2,000.

An important bearish trigger would happen if the price breaks and holds below the 200 SMA + ascending trend line. In that scenario, we suspect further selling will follow and $1,400 would be the first major target. Given current conditions, we give a slight edge to bulls, but they still have some hurdles ahead.

BNBUSD (Binance)

Despite the latest regulatory issues with the US SEC, Binance Coin is currently up 4.7% for the last 7 trading days. It shouldn’t be a reason for enthusiasm because we can see the bounce is just a blip compared to the impulsive selling witnessed at the beginning of June.

As a result, we remain bearish on BNB as long as the price trades below the 20 EMA. We may see a new retest of $220, a key support that managed to cap the downside. Breaking below would be bad news for bulls and the price would be headed towards $180.

Another interesting thing to note is that Binance Coin has been trading inside a range ($336 – $220) for over a year. While that shows a sign of equilibrium, breaking the structure on either side will very likely be followed by a strong directional move.

We suspect any new strict measures from regulators regarding the crypto industry has the potential to further dampen sentiment. Also, an easing pressure would suggest there’s scope for a move up, towards the other side of the range.

There are no comments at the moment, do you want to add one?

Write a comment