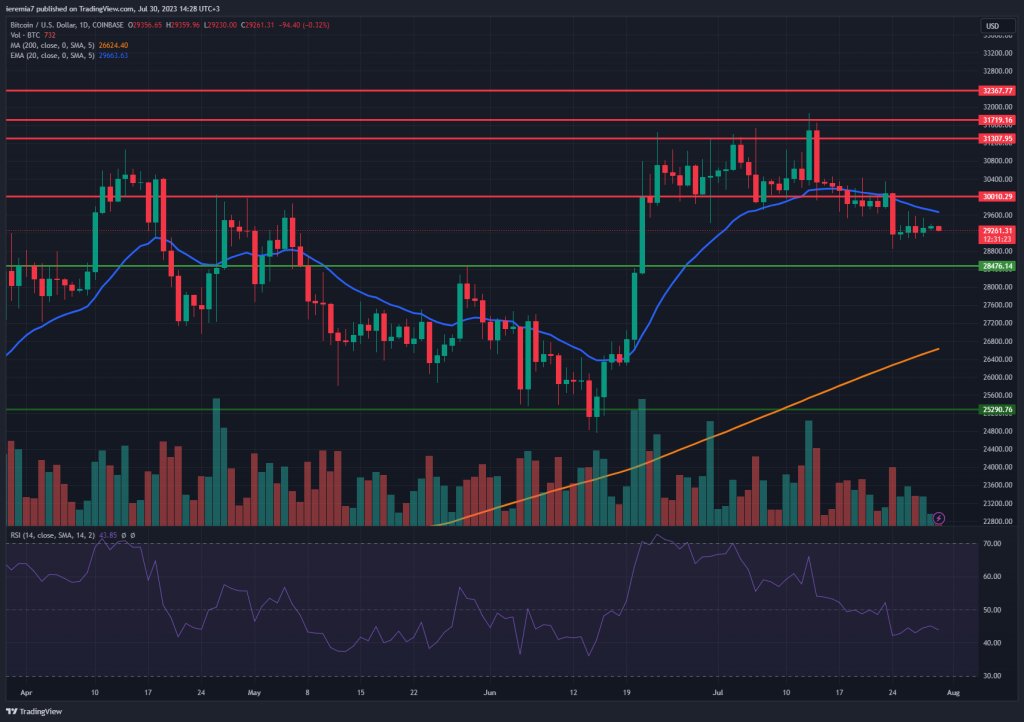

BTCUSD (Coinbase)

Bitcoin broke below $30,000 on Monday and since then consolidated below the level, suggesting the market sentiment shifted as a result. The daily chart shows the price trading below the 20 EMA and the RSI heading south, which is a situation favorable for sellers.

However, when looking at the bigger picture, the coin continues to be in an uptrend and this is just a corrective move thus far. As we enter the month of August, when choppiness is expected, traders should closely monitor how the price reacts to some key levels.

If selling persists, we advise buyers to watch for setups around $28,500. This level has been highlighted in the past and should spark some bids. Naturally, if the price breaks impulsively below, the attention will shift towards the daily 200 SMA.

On the upside, buyers need to break back above $30.000. Only on a daily close above that price tag, we should expect further gains towards $31,700 and even $32,000. For now, the market seems to be in a wait-and-see move, looking for an upside catalyzer.

ETHUSD (Kraken)

Ether is flat for the week, but sellers are again in control, judging by how the price is treating the 20 EMA on the daily chart. We can see how selling emerged once the price touched the blue line, which is not an encouraging sign for bulls.

Renewed selling next week will pressure $1,830 once again and we could see some bullish interest around $1,800, which is also a psychological level. Not too far is the 200 SMA and traders are expected to put a greater emphasis on that. At the end of June, the price touches the orange line and then rallies impulsively, so such a scenario should be considered again.

The upside seems to be capped by $2,00, given strong rejections off that level. However, on a break and hold above, the situation will improve substantially for buyers. Let’s see if August will come with more gains for crypto.

DOGEUSD (Binance)

Enthusiasm is growing among dog coins as we can see Dogecoins up 10% for the week. Technically, this cryptocurrency is now in bullish territory, given it managed to break above the daily 200 SMA.

DOGE touched 5.5 cents at the end of June and since then managed to stage a 40% bounce. That is the level where the price rallied last October, which confirms the market is paying close attention to these areas on the chart.

Because there is a short-term bullish parabolic structure on the daily chart, we believe there’s scope for further upside. Dogecoin could rally towards 9.5 cents, where a falling trend line is expected to cap gains. In the meantime, the 20 EMA should act as support when pullbacks take place.

A break and hold below it will be the signal that sentiment shifted in favor of bears. In that scenario, we expect the price to retest 5.5 cents and the potential for a break lower will materially increase. For the time being, at least, we favor the upside, as buyers look confident to buy DOGE on dips.

There are no comments at the moment, do you want to add one?

Write a comment