Bitcoin

The Bitcoin price had been under pressure at the beginning of the week, reaching the 6,000 area and since then it had managed to rebound towards the 9,000 level. However, even though this bullish corrective move took place, the price action context does not show that a market reversal took place. From the contrary, we believe that the bullish move could be a great opportunity for sellers to step in again and pressure the monthly lows. There is still risk aversion when it comes to cryptocurrencies and investors are dumping their coins as the selling frenzy continues to extend. The price of Bitcoin is down more than 50% since the start of 2018, which is exactly the opposite of what analysts predicted. Support recently emerged around 7,950 area and if that level will fail we expect a new round of selling towards the 6,000 area. On the other hand, if buyers continue to push the price action higher, 9,000 and 10,800 could follow.

Source: dailyfx.com

Litecoin

Very similar to Bitcoin, the Litecoin price had the same behavior. It dropped at the beginning of the week and then rebounded higher. We can notice a support area that had been touched twice, around 108 area. Also, we can see a resistance level around 170 which had also been touched twice. That means we are in a ranging environment and we expect a breakout in order to see which side of the market will manage to win the battle. A break on the upside, above 170 will open more room for buyers towards the 200 area, where sellers are expected to step in again. If the sellers will drive the price action lower, 134 level is a nice swing point and some buyers are expected there. If the level won’t manage to hold, further slides towards 108 support could be seen then.

Source: dailyfx.com

Ripple

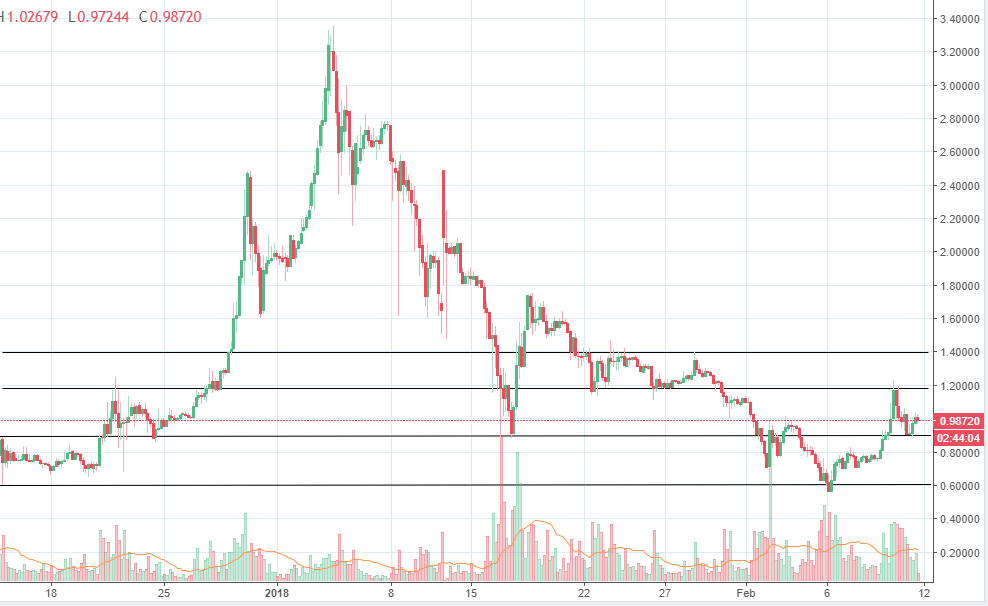

Ripple managed to recover around 35% since it reached a 2018 low around 0.55. At the time of writing the price action is located around 0.98 and the bullish leg up looks like the buyers had resumed impulsively. The move encountered resistance around 1.18 and since then sellers had been in control. If buyers will manage to clear out that resistance, we expect the recovery to continue towards 1.39. However, after such impulsive selling that we saw since the start of the year, we expect the price action to consolidate for a considerable amount of time before potentially resuming the bullish track. Support is expected around 0.89 and if that will fail, the yearly low around 0.55 could be under pressure again.

Source: dailyfx.com

There are no comments at the moment, do you want to add one?

Write a comment