Introduction

October 21, 2024 – In a significant milestone for the Bitcoin network, the cryptocurrency’s hashrate has surged to an all-time high, driven primarily by publicly-listed mining companies. While this development highlights the growing institutionalization of Bitcoin mining, it has also sparked concerns about the centralization of a once largely decentralized network.

The hashrate, which refers to the total computational power used to mine and secure transactions on the Bitcoin blockchain, is a key metric that determines the network’s security and robustness. As Bitcoin continues to gain acceptance from mainstream investors and institutions, publicly-listed mining companies have rapidly expanded their operations, contributing to this historic peak.

Understanding Bitcoin’s Hashrate

Bitcoin’s hashrate represents the total amount of computational power that miners use to solve complex mathematical problems, which are essential for validating transactions and securing the network. Measured in terahashes per second (TH/s), the hashrate indicates how many trillions of calculations Bitcoin miners perform every second. A higher hashrate makes the network more secure against attacks, as it would require an immense amount of computational power to manipulate or alter the blockchain.

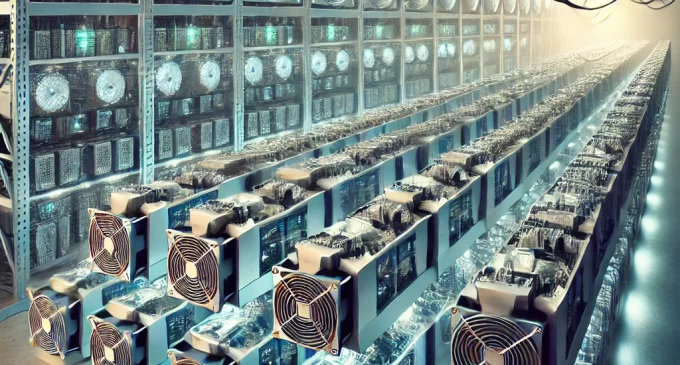

In October 2024, Bitcoin’s hashrate surpassed 700 exahashes per second (EH/s), shattering previous records. This unprecedented surge is largely attributed to the increasing involvement of publicly-listed mining companies that have access to significant capital and resources. These firms have ramped up their mining operations by investing in state-of-the-art hardware, creating massive mining farms, and leveraging cheap energy sources to maximize profits.

The Rise Of Publicly-Listed Bitcoin Miners

In recent years, publicly-listed mining companies like Riot Platforms, Marathon Digital Holdings, and Core Scientific have become major players in the Bitcoin mining space. These companies have rapidly expanded their mining operations by securing partnerships with energy companies, acquiring the latest ASIC (application-specific integrated circuit) hardware, and setting up large-scale mining facilities across North America and other regions.

The appeal of these companies for investors is twofold: they offer exposure to Bitcoin without the need to directly buy or hold the cryptocurrency, and they benefit from economies of scale that allow them to mine Bitcoin at a lower cost than smaller, independent miners. The increased involvement of these publicly-traded companies has led to a consolidation of mining power, as they control a larger share of the network’s total hashrate.

The Centralization Debate

While a higher hashrate strengthens Bitcoin’s security, it also raises concerns about centralization. One of the core principles of Bitcoin is decentralization, where no single entity or group should have disproportionate control over the network. However, the rise of publicly-listed miners has sparked debates over whether the network is becoming too centralized.

Centralization risks arise when a few large mining entities control a significant portion of the hashrate. If a small number of miners control more than 51% of the network’s computational power, they could theoretically launch a 51% attack, where they could double-spend coins or prevent transactions from being confirmed. While such an attack would require immense resources and coordination, the concentration of mining power in the hands of a few companies increases the theoretical risk.

In October 2024, publicly-listed miners were estimated to control over 40% of the Bitcoin network’s total hashrate, with independent and smaller-scale miners making up the rest. While this level of concentration has not yet reached dangerous levels, it has sparked concerns within the Bitcoin community about the future of the network’s decentralization.

Impact On Independent Miners

The dominance of publicly-listed mining companies poses challenges for independent and smaller-scale miners. These miners, who have traditionally been the backbone of the Bitcoin network, are finding it increasingly difficult to compete with the large-scale operations of public companies. The economies of scale enjoyed by publicly-listed miners, combined with access to cheaper electricity and cutting-edge technology, give them a significant competitive advantage.

As a result, many independent miners have been forced to either scale down their operations or shut down entirely. This trend has raised concerns about the long-term viability of small miners and their role in maintaining a decentralized network.

Energy Consumption And Environmental Concerns

The increase in Bitcoin’s hashrate has also reignited debates over the network’s energy consumption. Bitcoin mining is an energy-intensive process, and as more computational power is added to the network, the energy required to maintain the network increases as well.

Publicly-listed miners, with their massive operations, are significant contributors to Bitcoin’s overall energy consumption. While many of these companies have made efforts to use renewable energy sources, such as wind and solar power, the environmental impact of Bitcoin mining remains a contentious issue.

In response to growing environmental concerns, several mining companies have pledged to increase their reliance on renewable energy. For example, Riot Platforms announced that over 75% of its energy consumption comes from renewable sources. However, critics argue that these efforts are not enough to mitigate the environmental impact of the network’s growing energy demands.

The Future Of Bitcoin Mining

As Bitcoin’s hashrate continues to climb, the debate over centralization and energy consumption will likely intensify. Publicly-listed miners will play an increasingly prominent role in the network, but the question remains whether this trend will undermine the core principles of decentralization that Bitcoin was built upon.

To address these concerns, some in the Bitcoin community have proposed solutions such as decentralized mining pools and energy-efficient consensus mechanisms. Others argue that as long as the network remains open and permissionless, the benefits of increased security and institutional involvement outweigh the risks of centralization.

The coming years will be critical in determining the direction of Bitcoin mining. If the current trend continues, we may see further consolidation of mining power among publicly-listed companies. However, innovations in mining technology and energy sources could help strike a balance between decentralization and efficiency.

Conclusion

The record-breaking hashrate achieved in October 2024 is a testament to the growing maturity and institutionalization of Bitcoin. While this development strengthens the network’s security, it also raises important questions about centralization and the role of independent miners. As the Bitcoin network evolves, maintaining a balance between security, decentralization, and sustainability will be crucial for its long-term success.

There are no comments at the moment, do you want to add one?

Write a comment