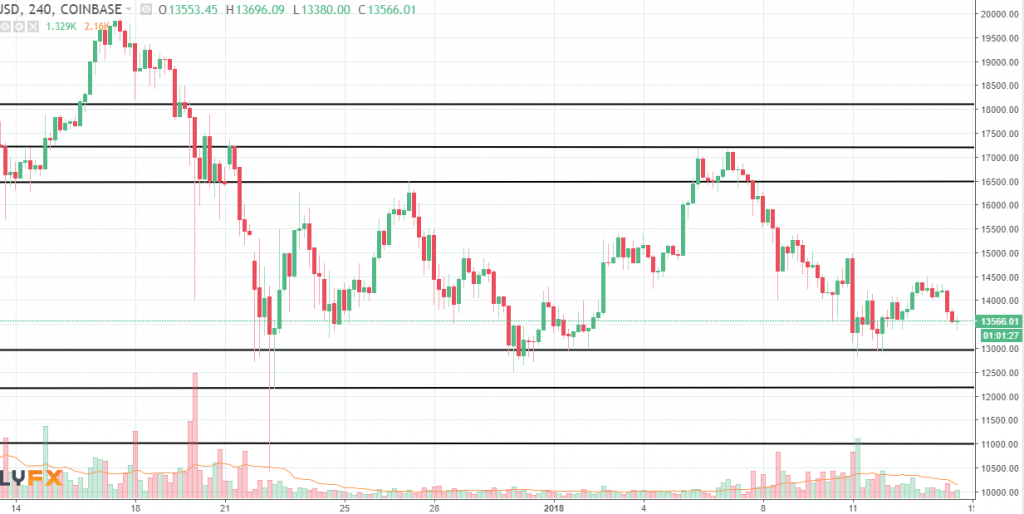

Bitcoin

Over the last week, the bitcoin price had dropped significantly after reaching a peak around 17,000. Since then a wave of selling had started, driving the price towards the 13,000 area. Fear had returned among cryptocurrency investors as highlights pointed towards the South Korea government wanting to ban cryptocurrency exchanges. Since South Korea provides a considerable amount of the daily liquidity, most of the important coins had been under pressure.

Source: dailyfx.com

At the time of writing there is no sign of buyers wanting to start to push the price higher. However, if we look at the long-term picture, we can spot a ranging environment on the 4h chart. Strong support should be found around the 13,000 area, where the bottom line of the range is located, while on the upside 16,500 is the top line of the range, from our point of view. Looking ahead, we expect the price to fluctuate inside the range with a slight bias towards the sell side. As long as the uncertainty of the South Korea situation will continue, we do not expect any major rebound to take place.

A break below the bottom line of the range could open more downside ground towards the 12.250 area. If that won’t make buyers to step in again, we could see further slides towards the 11,000 area.

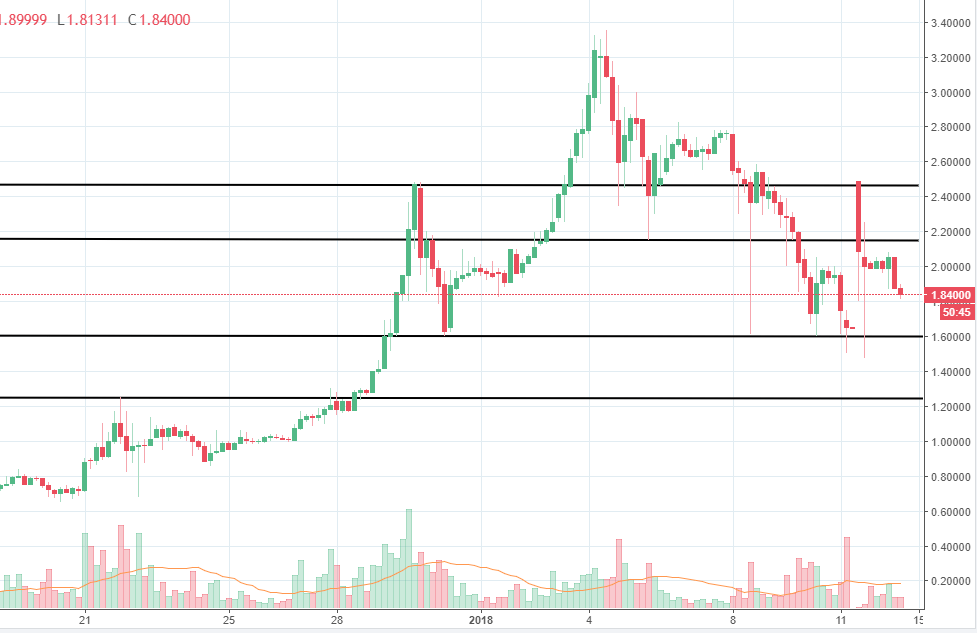

Ripple

The Ripple price had slumped around 30 % over the past week, after the disappointing announcement from Coinbase that we’ve talked about last week as well. The 2,46 key level did not manage to withstand the selling pressure and the price slumped towards 1,61, where we can see buyers emerged four times only in the last week. The price had been boosted on Friday by news from MoneyGram, which announced it would adopt XRP in an open-ended pilot. The news had boosted the price towards the 2,46 but selling pressure resumed again around that area and all the gains had been erased in less than eight hours.

Source: dailyfx.com

Since we can see buyers emerging several times around 1,61, we expect it to trade above the level in the following week. Also, at the level, there is a good opportunity to buy the coin. The buyers will need to break above 1,61 level in order to be able to put pressure on current yearly high around 3,34.

On the downside, a break below the 1,61 support could expose 1,25 level, but we should see a break below the 1,61 first.

Sellers seem to be in control at the moment, but we expect to see how long that will continue.

There are no comments at the moment, do you want to add one?

Write a comment