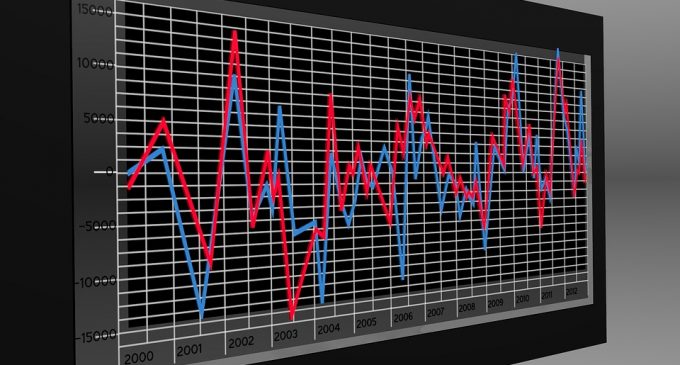

BTCUSD Coinbase

Source: tradingview.com

Bitcoin started the week on an upward beat, but the sentiment was reversed by the Fed’s Powell Congress hearing, where regulatory concerns on Libra were discussed. Since then, Bitcoin broke back below the key $11,700 level and seems to be heading towards the 4h chart 200 moving average.

The MA and the $9,900 area represent key support levels and if buyers won’t be able to keep the price above them, we could see Bitcoin continuing to slide lower as summer unfolds. A break below the current July low, located at $9,651, would be an indication for increased sellers’ momentum.

On the flip side, if the MA will hold, we could see a new retest of the $11,700 level, but from our point of view, that seems like the less likely scenario, considering that the price action structure is tilted in favor of the sellers at the time of writing.

ETHUSD Kraken

Source: tradingview.com

The Ether price action picture switched towards the sellers on July 11th, when the price broke below the 4h chart 200 moving average. We’ve highlighted in our last weekly crypto analysis that’s a key support area and as you can see from the chart, there’s a little reaction from the buyers following the breakout.

Looking ahead, now that sellers regained control over the order flow, we could see Ether continuing to grind lower, towards the $233 support area, where some swing lows can be spotted. It could take more than a week until price reaches it, but overall, the momentum switched to the sellers.

If buyers resume, we should expect the 200 MA to be treated as resistance instead of support, and above it, our key resistance zone formed by $300 and $322 should bring new sellers into the market. While the price remains below that zone, we’ll keep our bearish bias in place.

BCHSVUSDC Poloniex

Source: tradingview.com

We’ve included Bitcoin SV for the first time in our weekly crypto analysis a week ago and we’ve mentioned at that time that the coin is trading inside a range and an eventual breakout will occur.

July 11th was the day when the breakout occurred and since then Bitcoin SV had been under pressure. It is possible that we may witness a new retest of the broken structure, but the bottom line is that the price is very likely headed towards the $118 key support area, which we’ve highlighted as well last week. The overall price action picture looks like a traditional pump and dump scheme.

Only a strong breakout inside the range will negate our current bearish view, but that will take a huge effort from the buyers and is, at the present time, the less likely scenario.

Briefings about ICOs

Until August 1st, Coinshare will continue to raise funds through the Latoken exchange, as it attempts to create a Cashback system for people to be rewarded each time they make purchases. The company already raised more than $3 million.

BlackPearl.Chain is an interesting upcoming ICO project, which will start on July 25th. Its solution aims to push decentralization into the future with a third generation blockchain, that will enable mobile devices, PCs, Cloud/Data Centers servers to run as nodes.

There are no comments at the moment, do you want to add one?

Write a comment