BTCUSD (Coinbase)

We were expecting a continuation higher last week and that materialized, with BTC breaking above the daily 200 SMA impulsively. That’s a bullish sign and shows liquidity is back into the market, supporting valuations.

Before we dig into technicals, we would like to caution that the market might be a bit ahead of itself, simply because the risk factors (trade tensions, poor economic activity, stagflation, etc.) have not vanished completely. Yet, traders and investors seem to behave like all of these are in the rearview mirror.

BTC found some temporary support around $95k, but the selling looks rather muted thus far. If there is a break above last week’s high, then we could see an extension towards $100k, another important resistance.

To the downside, there is a confluence of support levels at $89k, so buyers might want to monitor the price behavior there, if there is a pullback unfolding. We think this market still faces headline risks, so make sure you are not stuck with a fixed trading idea. Volatility should remain elevated in the near future.

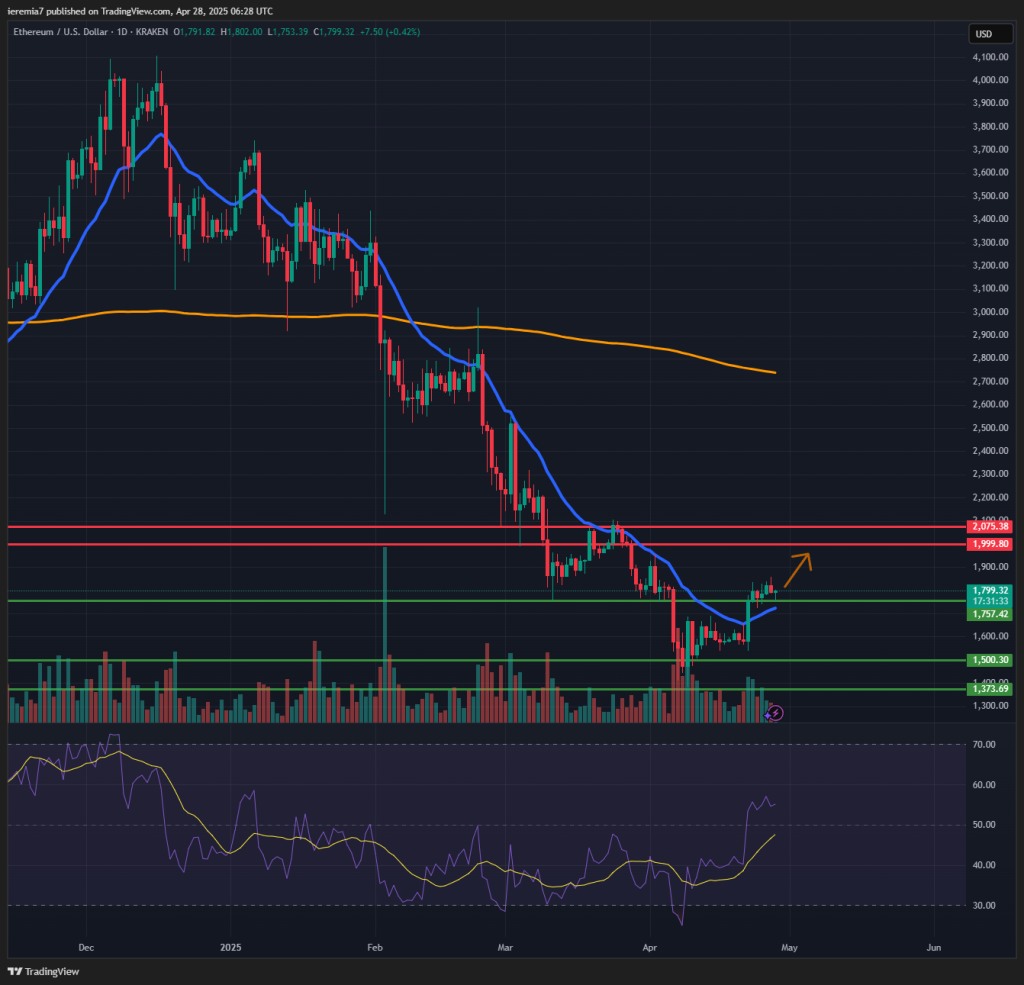

ETHUSD (Kraken)

Ether also staged a nice rally last week, breaking above the daily 20 EMA and continuing to edge higher after that. Despite a choppy price action intra-day, buyers managed to add more gains, driving ETH above our $1,750 resistance level.

Still, we are not too far from that area, which leaves the market vulnerable to sudden selling. If that happens and Ether gives back the 20 EMA, sellers could be incentivized to step in. In that scenario, $1,500 is our critical support that needs to be held.

As long as the structure remains favorable to buyers (higher lows, higher highs, pricing trending above averages), we think ETH should continue up into that $2,000 – $2,075 key resistance area. That’s where stronger sellers might emerge, which will lead to at least a temporary pause in the uptrend.

XRPUSD (Kraken)

We’re bringing the focus back to XRP, since a few days ago, a US-based ETF for this coin was announced. From a liquidity standpoint, that should be positive since it could spur new flows into XRP.

Looking at the price, we see buyers managed to turn the tide around the daily 200 SMA, despite a brief break below our range. Such situations can lead to shorts being squeezed out of the market, pushing the price up.

That does seem to happen, with XRP managing to break above the daily 20 EMA and now treating it as support. The RSI is also not yet overbought, suggesting this rally could still have legs until exhaustion.

Considering all of these, there is an increasing possibility XRP continues to move up into the $2.9 key area, where the upper side of our range is located. We will stick with this view until the market selloff and XRP breaks below the range again. That will be a technical shift, but for now, buyers hold the upper hand.

There are no comments at the moment, do you want to add one?

Write a comment