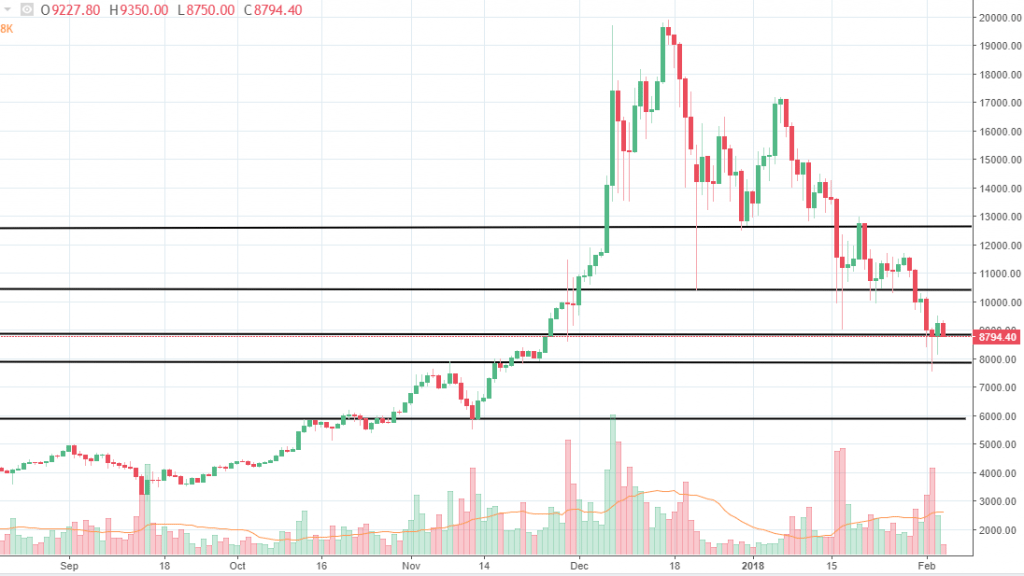

Bitcoin

For the last week, the Bitcoin price had been under pressure, continuing the downside trend that started and the beginning of 2018. Following a consolidation that we’ve talked about last week, sellers resumed impulsively and broke below the monthly low around the 9,000 figure and the price reached 7,500 on the Coinbase exchange. We’ve marked on our chart a support area formed by 8,800 and 8,000 levels, which we expect to generate some buying interest. If not, and the selling will continue at the same pace, the downside trend could continue towards the 6,000 figure. This week all the next have been negative for Bitcoin and cryptocurrencies. Officials from India gave pessimistic remarks about the use of Bitcoin and also there have been rumors that the Bitfinex exchange has been manipulating the price of Bitcoin. However, if the bulls will manage to accumulate around the mentioned support area, we expect a rebound towards the 10,500 area.

Source: dailyfx.com

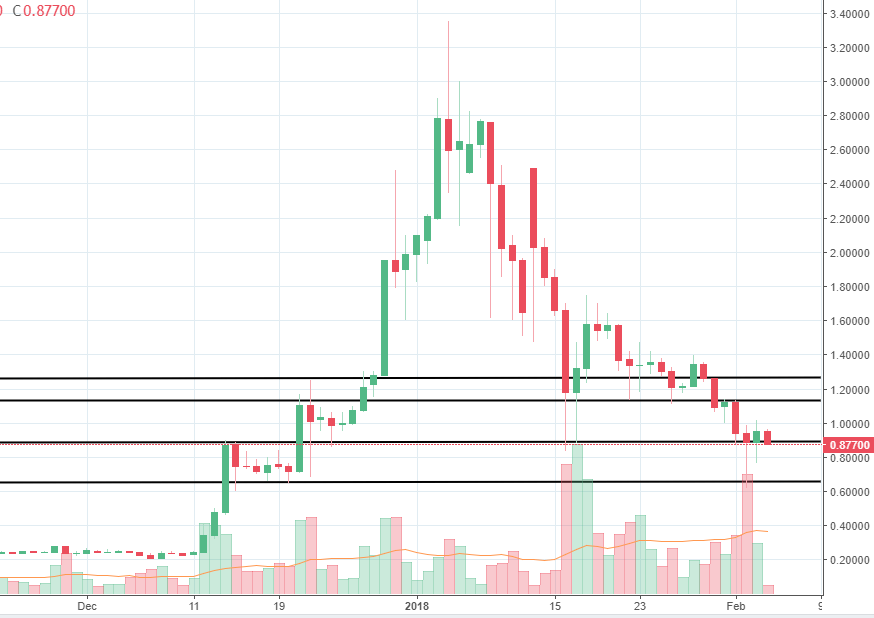

Ripple

Ripple had been under pressure as well, as the selling frenzy drove down all major cryptocurrencies. The fear of regulation is still the main driver of the bearish trend and Ripple is not excluded by the sellers. Five of the last daily candles had closed red and the price is lower by 35-40%. We can see buyers emerged around 0.65 area and also we need to mention the 0.89 area, where the price is currently located. Those are levels where buyers have reacted in the past and the same could happen again. However, we do not expect a major rebound higher following the slump we saw last month. Still, we expect the price to be able to consolidate towards 1.13 or even 1.22 area, as buyers could step in around the lows.

Source: dailyfx.com

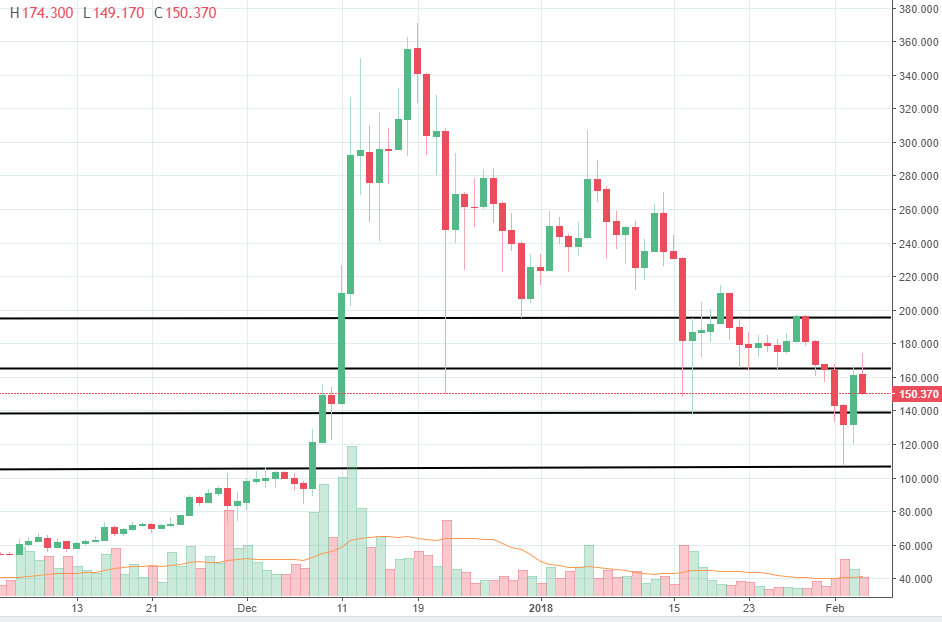

Litecoin

Litecoin is another major cryptocurrency that got hurt during the last seven days, the price slumping from 195 to 106 on the Bitfinex exchange. We can see a bearish parabolic structure on the daily chart and so far there is no clue that the move could stop soon. Today the sellers resumed after a good performance yesterday. We’ve marked the 165 area which is, from our point of view a good resistance and supply zone. Selling is robust and we could see 140 level under pressure very shortly. A break below it could send the price towards the 106 level, where the current year low is also located. We expect the downside to be limited below that level, as the buyers could step in and profit from the current oversold conditions. The market mood had changed dramatically in less than a month. Following the performances we saw last year, various experts predicted a stronger evolution for 2018, but exactly the opposite happened.

Source: dailyfx.com

There are no comments at the moment, do you want to add one?

Write a comment