Introduction

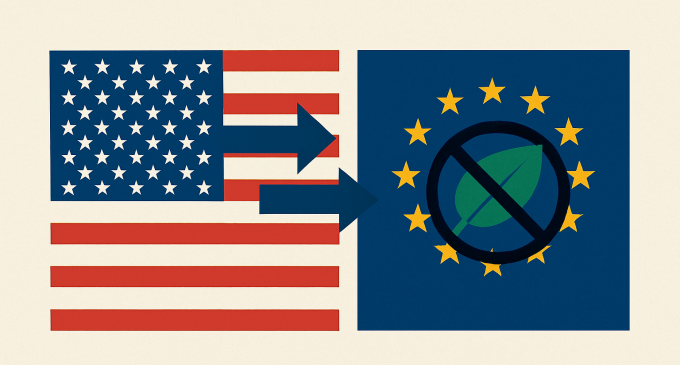

In a bold and controversial move, the United States government has formally asked the European Union to dilute key elements of its green regulatory framework. A newly revealed U.S. position paper urges Brussels to rescind requirements that non-EU firms furnish climate transition plans and to exempt U.S. companies from environmental due diligence obligations imposed under EU law. These demands come just months after a transatlantic trade agreement was struck, raising alarm in Europe about whether that deal can survive mounting pressure from Washington.

At the heart of the dispute lies a tension between the climate ambitions of the EU and the competitive interests of American companies, as well as deeper questions of regulatory sovereignty, extraterritorial authority, and the dynamics of global trade norms. This article explores the contours of the demand, the reactions it has provoked, and the potential implications for transatlantic relations, business strategy, and climate policy.

Background: EU Green Regulations And The Transatlantic Trade Pact

The EU’s Green Policy Framework

Over recent years, the European Union has adopted an increasingly ambitious regulatory agenda to embed climate and environmental goals into corporate conduct. Among these are climate transition plan requirements, which mandate that companies articulate how they intend to pivot toward lower greenhouse gas emissions over time, and environmental and human rights due diligence rules, imposing obligations on firms to trace and mitigate risks in their supply chains, including pollution, deforestation, forced labor, and other harms. Civil liability provisions enable regulatory penalties if violations are detected, and the rules have extraterritorial reach, meaning they apply not only to firms headquartered in the EU but also to non-EU companies operating in or exporting to the bloc.

These rules are part of a broader EU strategy to make the region climate neutral by 2050 and to integrate sustainability across trade, industry, and finance.

The Recent U.S.–EU Trade Framework

In August 2025, the U.S. and the EU announced a framework for a new trade understanding. Under that agreement, the blocs would impose a 15 percent import tariff on most EU exports to the U.S., while many U.S. exports to the EU would face no tariffs.

That pact was widely interpreted as a truce to avert a full-blown trade war, but it did little to resolve deeper disputes over non-tariff measures, especially in the digital, climate, and regulatory domains. Even before the recent demands, disagreements had already delayed the finalization of a joint trade statement, with digital regulations being a sticking point.

Thus, the new U.S. demands are not being made in a vacuum. They build on existing tensions over how far each side can impose regulatory norms on foreign firms, especially in areas touching ideology, sovereignty, and environmental goals.

The U.S. Demand: What’s Being Asked And Why?

Nature of the Demands

The U.S. position paper seeks several specific changes. First, it calls for the abolition of climate transition plan requirements for non-EU firms operating in the EU or exporting there. Second, it demands the exclusion of U.S. companies from environmental and human rights due diligence obligations under EU regulation, effectively carving out preferential treatment for American firms. Third, it asks for a rollback or weakening of civil liability provisions that allow lawsuits related to environmental abuses or labor violations in supply chains. More broadly, the U.S. characterizes the EU’s regulatory approach as a serious and unwarranted regulatory overreach that imposes heavy burdens on U.S. firms and hampers their competitive standing.

Crucially, the U.S. is not offering concessions in return. While trade deals normally involve bargaining, Washington is pushing these demands without reciprocity, which EU officials describe as a one-way street.

Rationale from the U.S. Perspective

From the U.S. viewpoint, several arguments are advanced. The regulations are burdensome, requiring firms to invest heavily in compliance, reporting, auditing, and legal risk mitigation. The rules are extraterritorial, applying to U.S. companies operating or exporting to the EU, which the U.S. sees as regulatory imperialism. The regulations also disadvantage U.S. businesses by exposing them to lawsuits and activist claims in foreign jurisdictions. Finally, the U.S. frames its position as defending competitiveness and fair trade, arguing that the EU’s approach tilts the playing field in favor of European firms.

This complements the broader deregulatory philosophy of the Trump administration, which seeks to roll back climate and environmental regulations at home and abroad.

European Reactions And Tensions

Official and Institutional Pushback

The U.S. request has provoked concern and skepticism within Europe. EU officials warn that dismantling core regulatory elements would effectively unravel the EU’s climate and social safeguards, undermining years of legislative effort. There is disquiet within member states that the trade agreement may become a vehicle for U.S. regulatory dictates to override European priorities. Analysts note that the U.S. approach runs counter to standard trade negotiation practice, which typically involves reciprocal concessions, and the absence of any U.S. offer has especially rankled EU officials.

Business, Climate, and Civil Society Concerns

The U.S. demand has also unleashed reactions from other quarters. European industry groups generally support green standards but worry about competitive distortions and compliance costs. Environmental NGOs and climate advocates argue that the U.S. demands represent a direct assault on the regulatory foundation needed to achieve Paris Agreement goals and warn that any rollback will reduce investor certainty and discourage green investment. Legal scholars raise red flags about sovereignty and extraterritorial regulation. Global observers view the dispute as a test case for how trade and sustainability will intersect going forward.

The Risk to the Trade Agreement

There is growing concern that U.S. pressure could unravel the broader trade pact itself. If Brussels resists, Washington may threaten retaliation or withdraw cooperation. Some EU officials interpret the demands as a tactic to extract further concessions down the line, altering the terms of what was assumed to be a stable agreement.

Strategic Implications For Stakeholders

For U.S. and Multinational Corporations

If the EU stands firm, U.S. firms may incur higher compliance costs, particularly in climate reporting, supply chain auditing, and legal defense. Companies may face lawsuits, class actions, or sanctions for environmental or human rights violations, even for upstream suppliers. Firms may reconsider locating production in or exporting to the EU or push for strategic carve-outs in regulation. Lobbying efforts are likely to intensify in Brussels, Washington, and industry associations.

For EU Policymakers and Regulators

EU authorities must balance climate ambition with competitiveness, deciding whether to defend their regulatory agenda or concede ground to preserve trade stability. Member states with heavy export interests may push for softening rules or exemptions under domestic industry pressure. The response will set a precedent for future trade negotiations with other blocs. Maintaining legitimacy is also key, as concessions may be perceived as weakening climate commitments.

For Global Climate Policy and Trade Norms

The case deepens the debate over whether trade rules should trump environmental regulation or be constrained by them. Other countries might follow the U.S. approach and push back on foreign regulations, increasing fragmentation in global norms. Regulatory backsliding could also shake investor confidence in green transitions.

Possible Scenarios And Outcomes

Resistance and Stand‑Off

The EU could refuse to yield. The trade deal may become moribund or unravel entirely. The U.S. might retaliate with tariffs or other trade measures. A broader transatlantic standoff could ignite disputes on digital, industrial, and climate policy fronts.

Concessions and Compromise

Brussels might offer selective rollbacks or carve-outs, such as exemptions for U.S. firms under certain thresholds or sectors, delayed compliance phases, or adjustments to liability provisions. Such compromises may preserve the trade pact but weaken regulatory stringency.

Layered Differentiation

The EU could retain its rules but allow differentiated compliance paths or mutual recognition mechanisms for non-EU firms meeting certain international standards. This approach preserves ambition while offering flexibility.

Reframing the Deal

The EU could demand countermeasures or renegotiations in other areas such as digital regulation, subsidies, or industrial policy, shifting the negotiation terrain more broadly.

Analysis: Risks, Tradeoffs, And Broader Themes

Sovereignty and regulatory authority are central tensions. The EU frames its rules as democratically approved internal legislation, while the U.S. views them as extraterritorial impositions. The clash tests the boundaries of regulatory authority in global trade.

Climate ambition versus market realities is also a challenge. Even among climate-aligned countries, regulatory ambition must contend with costs, compliance, and global competition. The U.S. move underscores that states with lighter environmental regulations resist strict regimes, complicating unified climate action.

Political signaling is another factor. The U.S. demand signals that green rules may be negotiable under trade pressure. This could be a precursor to disputes over digital regulation, labor standards, tax policies, and critical technologies. The transatlantic frontier is becoming a battlefield for competing visions of governance.

Conclusion

The U.S. push to force the European Union to roll back its green regulations marks a pivotal moment in the evolving interplay of trade, climate policy, and regulatory sovereignty. On one side stands the EU’s ambitious agenda to embed environmental and human rights standards into corporate behavior; on the other, a U.S. posture that views those standards as barriers to competitiveness.

What happens next will extend far beyond a single trade agreement. It may reshape how states negotiate environmental norms, how companies structure global supply chains, and whether climate policies can survive in an era where trade instruments are wielded as geopolitical tools. Brussels must choose whether to defend regulatory integrity at the risk of diplomacy or yield to demands that could weaken the architecture of sustainability itself.

There are no comments at the moment, do you want to add one?

Write a comment