For a seamless trading experience, traders must know how to choose a reliable and trusted brokerage company among countless options available in the industry.

Faced with intense competition between different trading brands, we would like to bring forward a Londongroup Investments review highlighting some of the most critical offers you can get upon signing up. We hope it will serve as a helpful guide for individuals looking for a new and safe environment to trade in.

Account types

With a focus on catering to the varying requirements of traders worldwide, Londongroup Investments trading brand provides five different account options: Self-Managed, Select, Personal, Honors, and Wealth Management. It is affordable, with the Self-Managed activated with a minimum initial deposit of $250.

However, it doesn’t mean that the small account holders don’t have the chance to receive valuable features from them. They can get market reviews, access to more than 200 tradable assets, and leverage up to 1:100. When the account is upgraded, other premium trading benefits such as priority support from a dedicated senior manager, bonus funds, risk management planning, educational resources, the invitation to live VIP events, higher leverage, and tighter spreads are offered with Londongroup Investments.

Education

We observed that the firm recognized the importance of education and allowed Select and Personal members access to monthly and weekly webinars to improve their trading knowledge. When we move to a higher account called Honors, they even let traders fully access webinars and analyses.

In addition to that, if you qualify for a Wealth Management account, you are granted personalized education based on your trading needs and preferences. Also, as mentioned in the previous part, you can deal with a personal assistant to enhance your trading performance when opening a Select account.

Participating in a trading room is part of the Select benefits offered by Londongroup Investments, which would help you understand the techniques to identify potential opportunities to make successful trades. Though all of these accounts need a large minimum deposit amount, what they get is worth it.

Support

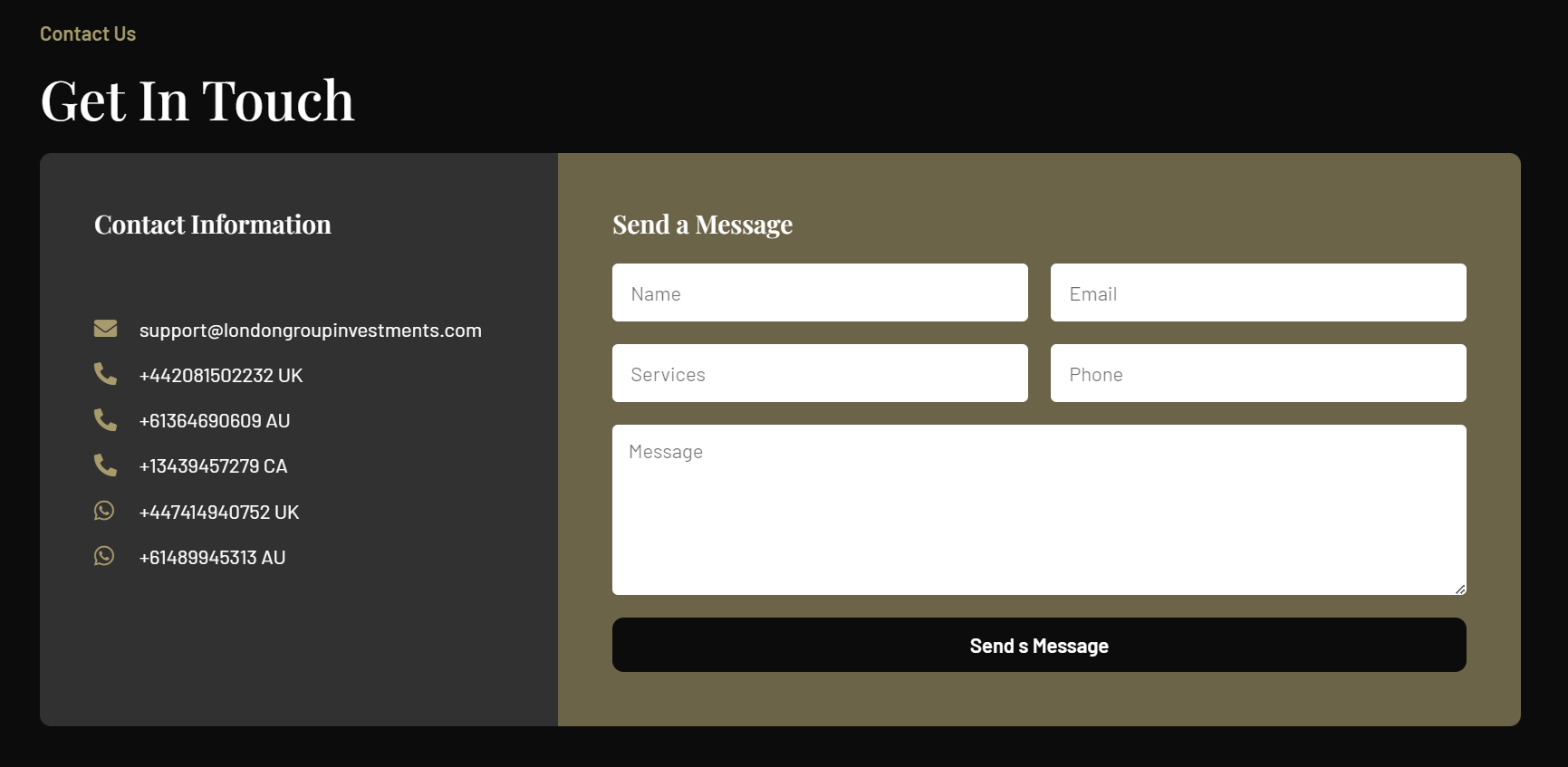

There are three ways to get in touch with the customer service team: email, phone calls, and a message form. The good news is that they offer phone numbers from several countries like the UK and Australia to quickly address any concerns or issues they may have.

When filling in the form available on the Contact Us page, you have to provide some basic details about yourself before leaving a message for them and sending it. Speaking of educational assistance, Londongroup Investments delivers a variety of knowledge materials, including tutorials, guides, and market insights.

Pros & cons

Pros

- The ability to get started with as little as $250

- Wide market access

- Multiple payment methods

- Transparent trading conditions

- Advanced charting tools

- Fast execution

Cons

- Do not provide services for residents of the United States

- Do not cover bonds and ETFs

Final words

After summarizing the pros and cons of the Londongroup Investments broker, it proves to be an ideal fit for traders wanting to expose themselves to global markets. The company shows their professionalism in every aspect we take into consideration. Our recommendation is to give it a shot if you find it a suitable option.

There are no comments at the moment, do you want to add one?

Write a comment