Bitcoin

Source: dailyfx.com

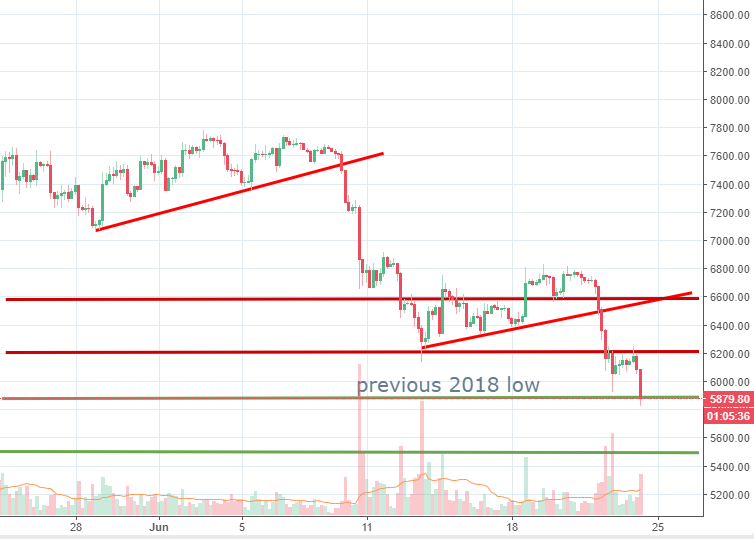

The Bitcoin price had been under pressure for the past few days and an hour prior to the time of writing it breached the 5,873 level, which was the 2018 low. Looking at the price action we see a series of recurrent structures composed of an ascending consolidation move, followed by a sharp drop.

Judging by the current conditions, we suspect the Bitcoin price will continue to weaken in the near term. Thus far, we see short-term profit taking around the above-mentioned level, but there is still no sign of impulsive buying around it.

Below 5,873, the next level to watch for support is the 5,480 area. There are some spikes on the daily chart, so we could see a new upward move emerge around it.

On the other hand, if 5,873 will manage to hold as support, we could see a retracement towards 6,200 or even 6,600 area.

Ethereum

Source: dailyfx.com

Pressured by the Bitcoin weakness, the entire cryptocurrency market had been in red for the past few days, including Ethereum. The main Bitcoin rival continues to slip, already breached the 445 previous weekly low and now looks set for a new retest of the 400-365 key support area. We’ve seen strong buying emerging around that level in the past, so the same scenario could repeat again.

At the time of writing, the price action is located at 442 so there is still more than 10% until the support area. We expect the bearish leg to be capped, at least short-term by it.

On the other hand, if the bulls will push the price on the upside, we suspect sellers will start to rejoin the downward trend around 520 level. A break and close above it on a daily basis could open more room towards the 619 resistance.

EOS

Source: dailyfx.com

Despite being one of the best performing cryptocurrencies in 2018, EOS is losing strong ground in dollar terms, losing around 30% in the last seven days. The big red candles we are currently seeing on the daily chart do not represent any good sign for the bulls and we expect the EOS price to continue to weaken towards 5.7 where some interest from the bulls can be seen in the past.

We have also spotted an ascending trend line, confirmed by two points and also backed by a support level located at 4,08 – both being able to act jointly as a key zone.

On the other hand, sellers wanting to rejoin the bearish trend could wait for a pullback towards 8.16 or 9.50, two significant resistance levels, where selling orders are expected to be parked.

The impulsiveness of the bearish leg keeps our bias tilted to the downside for the week ahead.

Briefings about ICOs

According to icoalert.com, FTEC is an active ICO that will run for 24 more days. FTEC is an ecosystem of intelligent services and neural networks for conducting effective trading activities on the cryptocurrencies market. Also, ALETHENA is another ICO which will run for 3 more days and it represents a Swiss blockchain-asset rating agency built on a fact-based due diligence methodology.

In terms of ICOs that will start in the near future, eo.trade will begin on July 16th. The project had been developed by the leading online broker expertoption.com and introduces 4 new products for the crypto world.

There are no comments at the moment, do you want to add one?

Write a comment