BTCUSD (Coinbase)

The market is back in full swing starting from Monday when we see Bitcoin up substantially. As things stand right now, the price action tilted in favor of bulls once again, and we suspect there are more gains to come.

We can confidently say that for several reasons. First, the falling trend has been breached, suggesting a reversal of trend. Second, the price trades above the $60k – $61k key role reversal area, favoring the bulls.

At the same time, during the last couple of hours, BTC managed to break above the 4h chart 200 SMA as well, leaving $65k as the next near-term resistance to watch. The move up is quite impulsive and we expect it to extend over a couple of weeks. As always, the focus will be on the all-time high around $74k, if the market marches ahead above $65k.

Additionally, buyers who want to enter at attractive prices might want to wait for a pullback. The key $61k – $60k is the first one to watch, followed by $58.5k and $57k. Below that last one, sentiment shifts again in favor of sellers.

ETHUSD (Kraken)

Ether is also edging up impulsively, currently testing the 200 SMA on the 4h chart. The move up is robust, suggesting there might be more gains to come in the short term. We can see from the chart that ETH is still below a falling trend line, so we need a break above $3,500 to suggest the bulls have resumed from a technical standpoint.

We think that’s very likely, as chatter around an ETF based on Ethereum reignited. The market is front-running the potential new flows that might come with such products, so we give an edge to a continuation higher. Above $3,500, our attention shifts towards $4.000, a major resistance and psychological level.

The market should buy pullbacks and we want to emphasize, the 20 EMA + $3,250. Those two form a pocket of support where bulls should turn the market up in case of a correction. We’ll shift to a bearish stance only if the price breaks and continues below $3,000.

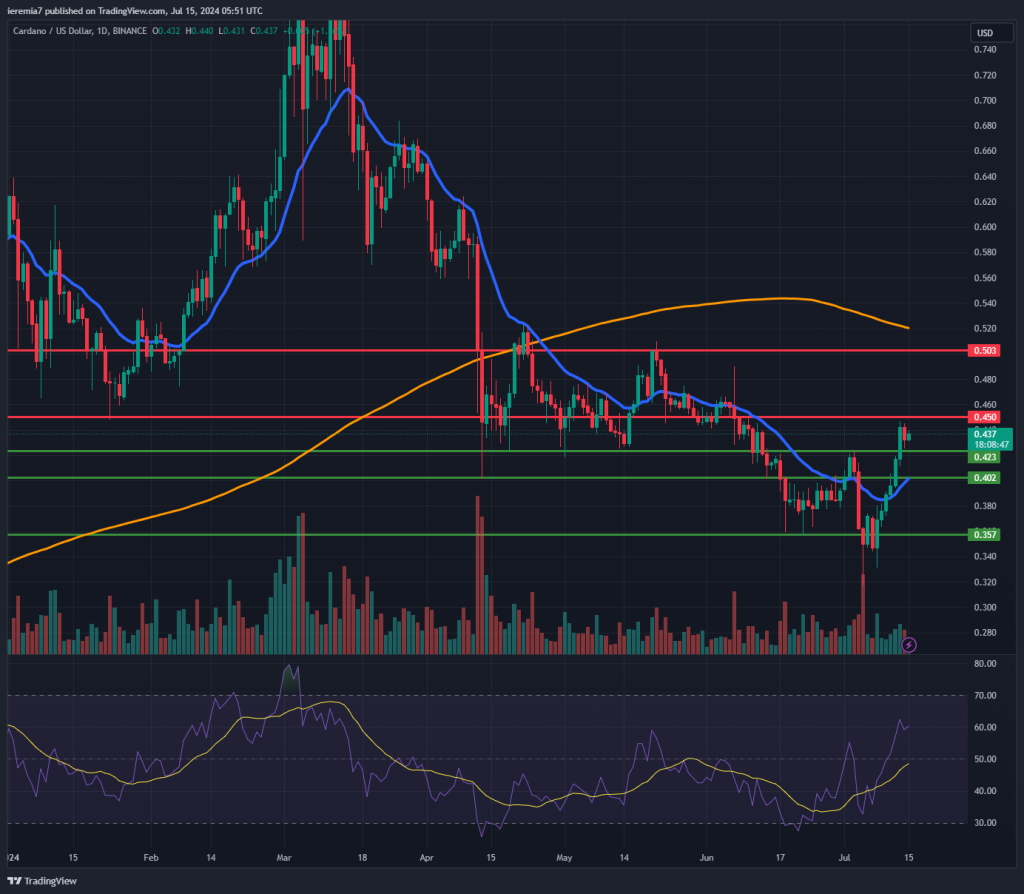

ADAUSD (Binance)

Cardano rallied for 6 consecutive days and despite a setback yesterday, the momentum seems to be changing in favor of buyers. The break above 42 cents was a key technical development, and now we believe there is room for more upside, especially since broad market sentiment continues to improve.

As a result, the next line of resistance is 45 cents and in case the market breaks above, attention will shift to 50 cents, where we expect stronger resistance due to the daily 200 SMA. If the market manages to get there, it will still be a bullish development in the broader picture.

Bumps along the way should be expected, given altcoins are known to be very volatile. Key support levels are 42, 40 and 35 cents. The first two should cap the downside if sellers start pushing the market lower again. Overall, we expect the week ahead to be bullish.

There are no comments at the moment, do you want to add one?

Write a comment