Bitcoin

Source: dailyfx.com

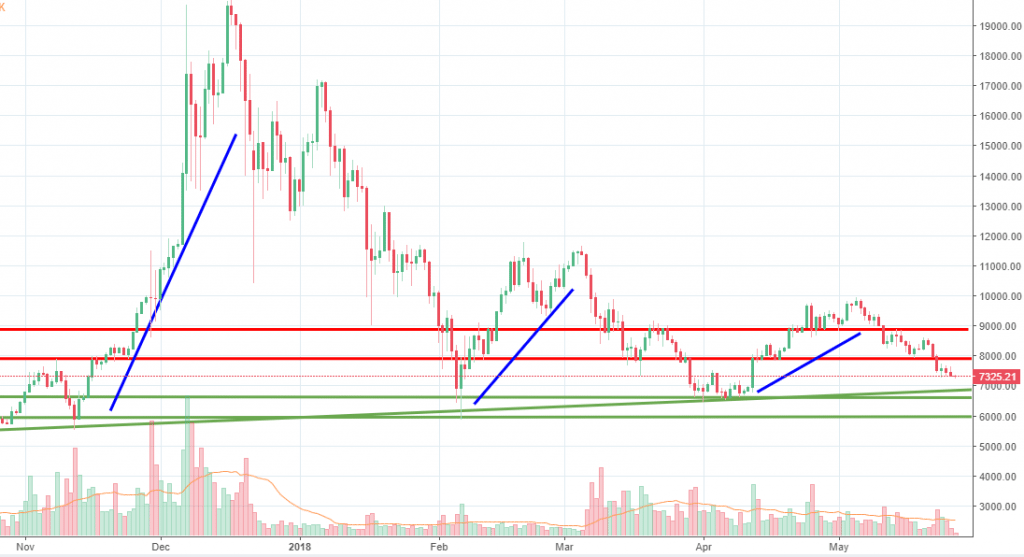

We are back with the price of Bitcoin of the daily chart, where the performance is not good for the buyers. The price had been under pressure since the beginning of May and the main reason had been an investigation started by the US Department of Justice wanting to find out whether traders had been manipulating prices.

From a technical point of view, the price action is heading towards an ascending trend that we’ve mentioned in the past as well. The line is confirmed by four points, so there could be buying interest around it. Also, little under the trend line, 6,600 should also play as a good demand zone.

The thing that worries us is the fact that since December 2017, each bullish leg up had been weaker. We’ve drawn some blue lines so you can notice the angles are different, suggesting a weakening in the power of buyers.

However, if the buyers will keep the price above the trend line, a new upward surge towards 8,000 could follow.

Ethereum

Source: dailyfx.com

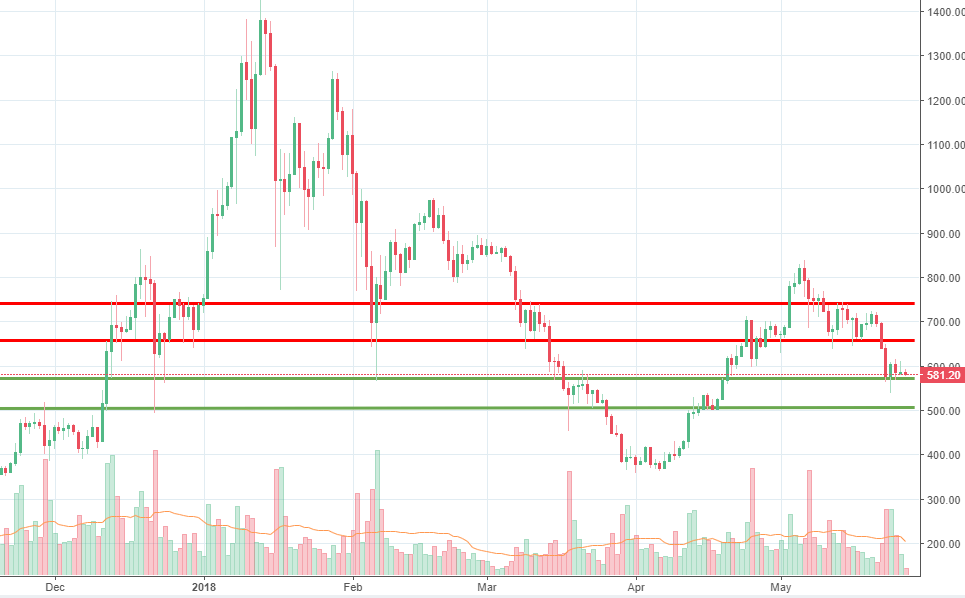

In line with the Bitcoin performance, Ethereum had also performed badly in May. With a few days left of this month, the coin is set to close with more than a 30% loss, compared to the high established in April. In the first three days of this week, the price had been heavily under pressure and since Thursday the selling eased.

However, the response we see from the bulls is not convincing at all since the support level located around 570 had not generated strong buying thus far. A daily close below it will open the door towards the 500 psychological area, where buying orders could be parked.

On the upside, sellers are expected to resume on short rallies. Resistance is expected around 657 and 747. We do not expect buyers to take control over the order flow anytime soon.

Monero

Source: dailyfx.com

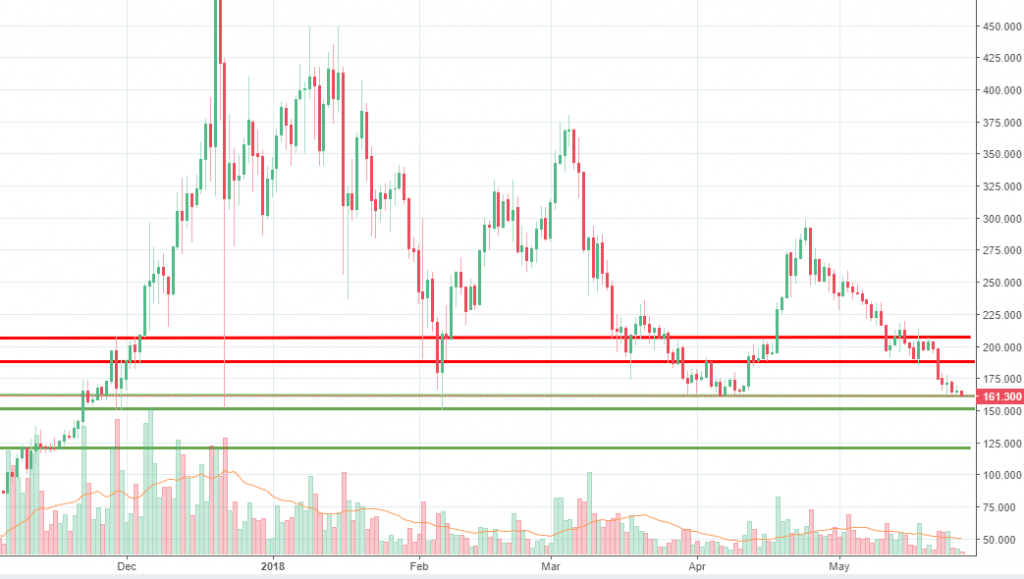

Monero had also been under pressure for the past week and we’ve decided to include it in this week’s analysis because the price is near a critical support area. The zone formed by 162-151 is a key support zone. We can see three bullish impulsive legs starting there, so it could be again a turning point.

We must also mention that the same situation seen with Bitcoin occurs here. Each bullish leg that been weaker than the previous one, suggesting a diminishing buying power is behind the price action.

A daily close below the support zone will open more room towards the 120 level. It will be a huge hit for the bulls and that is why we expect some intense activity around the current price level.

On the upside, 187 and 210 are the most important levels where sellers might resume impulsively, in case of a short-term rally.

Briefings about ICOs

According to icoalert.com, Stex Exchange is an ICO that is currently active. It is an exchange platform where traders can trade over 10,000 direct coin pairs. The ICO will run for 4 more days.

In terms of the ICOs that will start in the near term, XDAC will start on June 1st. It is a platform for creating and managing Decentralized Autonomous Companies.

There are no comments at the moment, do you want to add one?

Write a comment