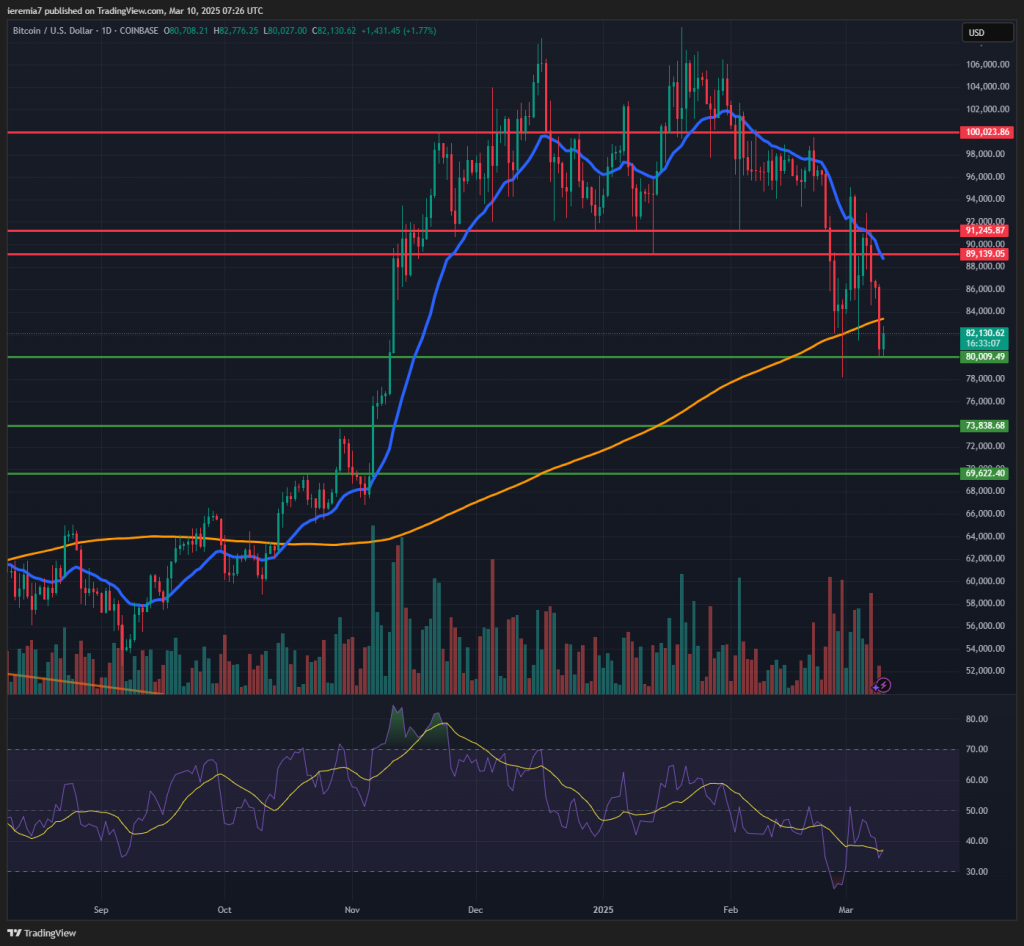

BTCUSD (Coinbase)

Enthusiasm failed to expand after the US announced a strategic Bitcoin reserve, since in reality it was just a government-owned stockpile. The market is obviously disappointed since the price is now trading below the daily 200 SMA.

The big picture favors bears, given we are seeing a bearish parabolic structure unfolding. There is room for more downside and we view the next likely target at $73,800, the former all-time high. Below that, $70k is another important area to watch, given selling usually tends to overshoot.

Not even the first US crypto summit that took place during the weekend managed to energize bulls. We need to see a recovery and the price edging high to believe a bounce to $89k is on the cards. We think that level + $91k will act as strong resistance. The market is clearly selling on rips, so traders need to watch lower time frames for pullback areas around moving averages.

This could be yet another choppy market, as buyers might be tempted to buy dips, only to see the price reversing sharply, forcing them to trim exposure and exacerbate the downside.

ETHUSD (Kraken)

Ether is in a much worse position since the price already cleared the Feb 3rd flash crash lows. The gains that came after the US crypto reserve announcement have also been wiped out, suggesting bears are clearly holding the upper hand.

So far, $2,000 managed to generate light support, which is why we believe that downside could extend further. The first support area comes at $1,900 – $1,860 and if it doesn’t hold, a deeper move down to $1,600 could follow.

On the upside, resistance comes at $2,150 and $2,300. As long as the price trades below the daily 20 EMA and below the bearish trend line seen on our chart, the sentiment will continue to be bearish. Finding tactical buys in this market is tricky, which is why traders should follow the dominant trend most of the time.

XRPUSD (Kraken)

XRP has also wiped out the gains seen early last week, showing the disappointment is spreading across all markets. After banking impressive gains during the last 3 months, the price is now seen consolidating in a wider range.

We can easily notice how $2.9 acted as resistance and $2 acted as support several times already. With that being said, traders should continue to play the range, as long as the structure will hold.

A break on either side could spur volatility. Above $2.9 we see potential for $3.35 and $3.5. Below $2, the downside could extend towards the daily 200 SMA and then $1.42. XRP should continue to be a volatile coin for the following weeks and months, which is not exactly good news for investors, but it will bring many trade opportunities for short-term traders.

The bullish trend continues to be intact, but these high valuations are always vulnerable to disappointment, is XRP adoption will fail to materialize.

There are no comments at the moment, do you want to add one?

Write a comment